A prediction suggests that the Bitcoin bull market could make a comeback following a $1.4 trillion liquidity injection in the US.

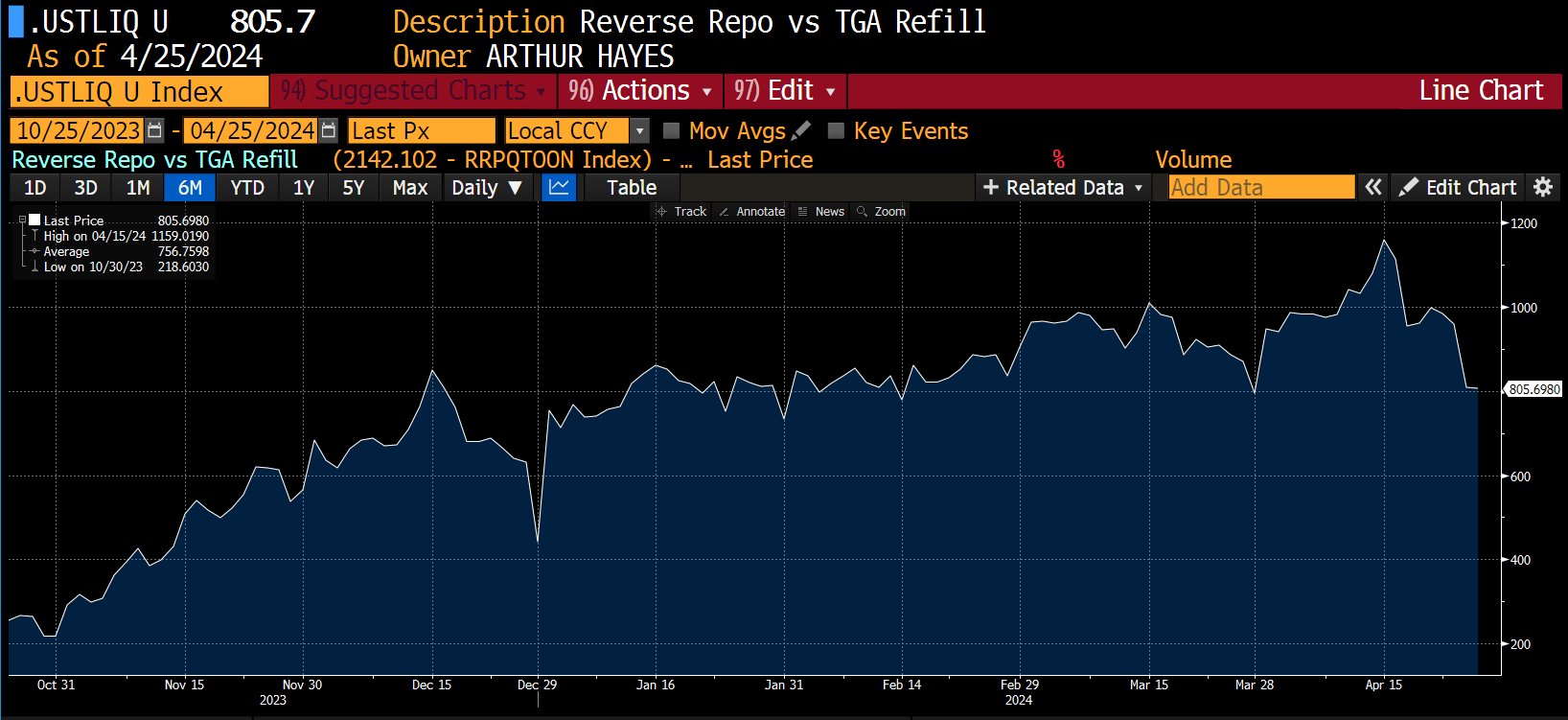

Arthur Hayes suggests that the Federal Reserve dropping interest rates to attract more liquidity into the economy is increasingly unlikely. Instead, he believes that Treasury Secretary Janet Yellen is the key figure to watch. On April 29, the U.S. Treasury will release the quarterly refunding documentation, outlining how the government will manage liquidity. Two significant liquidity sources to monitor are the Treasury General Account (TGA) and Reverse Purchase Agreements (RRPs). According to Hayes, tax receipts have added approximately $200 billion to the TGA, indicating potential liquidity implications.

Hayes suggests that draining either the Treasury General Account (TGA) or funds from Reverse Purchase Agreements (RRPs) can stimulate the economy, which is crucial for the performance of risk assets, including cryptocurrencies. He argues that the focus should be on Janet Yellen, as part of a theory suggesting that the printing of U.S. dollars will accelerate leading up to and after the upcoming Presidential Election.

Hayes outlines potential scenarios, such as a $1 trillion drain from the TGA, $400 billion in RRPs, or a combination of both, resulting in a possible $1.4 trillion liquidity injection into the economy. In summary, Hayes emphasizes that while the Federal Reserve may be considered irrelevant in this context, Janet Yellen’s influence is significant, and she should be respected for her role in shaping economic policy.

Bitcoin ETFs see “overdue” slowdown

Some observers believe that Bitcoin’s increasing adoption among mainstream investors will have a positive impact on its price, creating a feedback loop. However, Arthur Hayes predicts that the Bitcoin halving event will trigger a significant sell-off of various crypto assets.

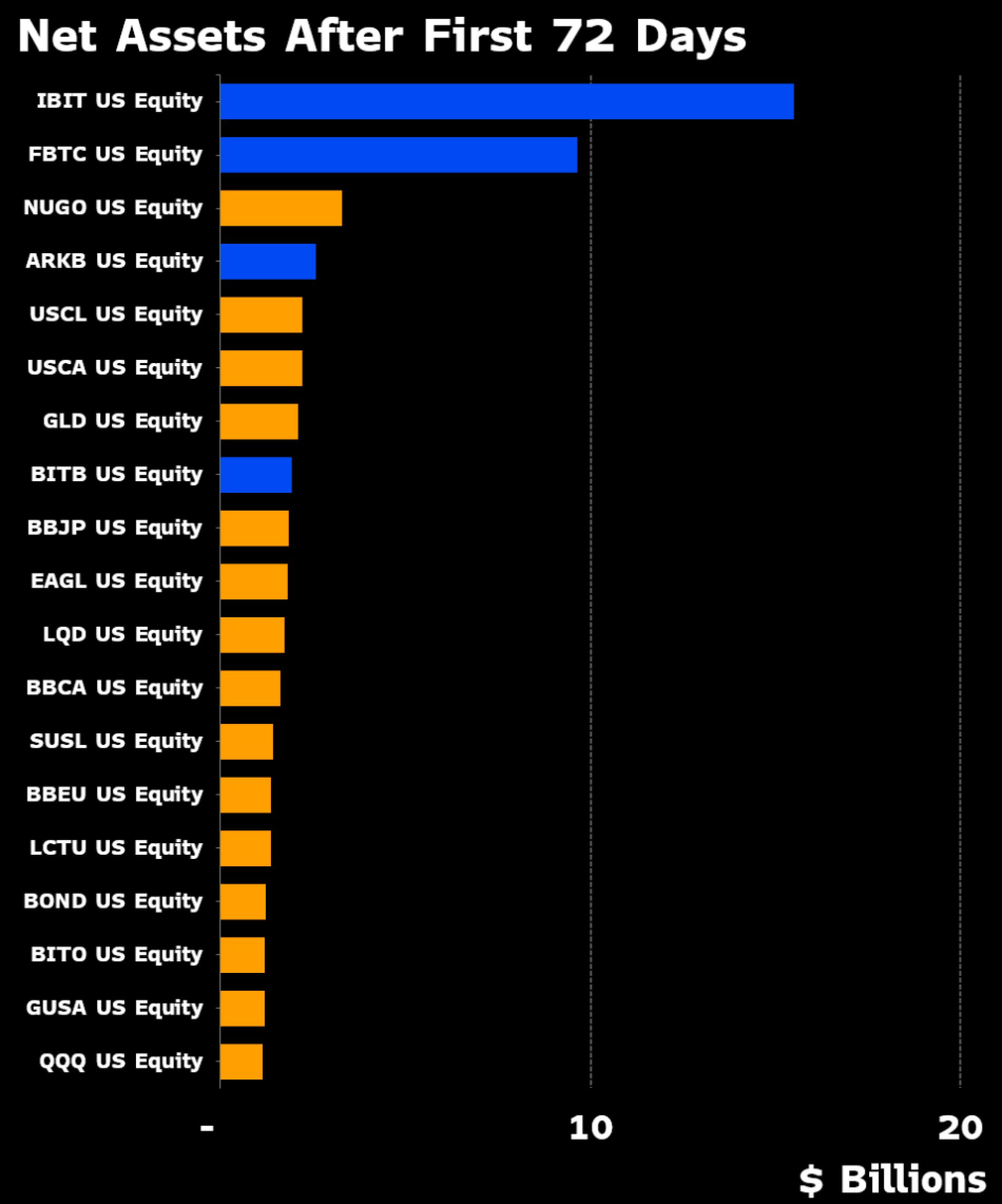

Despite the historic success of the debut of U.S. spot Bitcoin exchange-traded funds (ETFs), they have yet to reach their full potential audience. Eric Balchunas, an ETF analyst at Bloomberg, commented on BlackRock’s iShares Bitcoin Trust (IBIT), the largest product by assets under management excluding the Grayscale Bitcoin Trust (GBTC). He downplayed concerns about a recent decrease in inflows, noting that while IBIT’s streak of daily inflows ended after 71 days, it continues to set records. Balchunas shared Bloomberg data comparing ETF assets after the first 72 days on the market, highlighting IBIT’s continued success.

He added that “out of all the 10,698 registered funds in the U.S. (incl ETFs, mutual funds, CEFs) $IBIT currently ranks 2nd in YTD flows.”

While overall allocations remain small thus far, Cathie Wood, CEO of one spot Bitcoin ETF provider, ARK Invest, sees the trend gathering speed.

Bitcoin halving countdown is a topic of discussion among crypto experts, as it presents both opportunities and challenges for the cryptocurrency market.

The Bitcoin halving is a significant event occurring approximately every four years, where the reward for mining new blocks is cut in half. This process is coded into Bitcoin’s protocol to manage the creation of new bitcoins, ensuring that the total supply will never exceed 21 million.

The primary goal of the halving is to introduce scarcity to the digital currency, mirroring the concept of gold mining becoming more challenging over time. As the mining reward decreases, the rate of new bitcoins entering circulation slows down. This reduction in supply can impact Bitcoin’s price, as the scarcity of new coins can make existing ones more valuable, assuming that demand remains constant or increases.

Historically, Bitcoin halving events have often resulted in increased Bitcoin prices. This trend occurs due to the decreased supply of new bitcoins, making existing coins more valuable to investors.

Ken Timsit, Managing Director at Cronos Labs, shared his perspective on the upcoming Bitcoin halving event. He emphasized that the process is now more about the expectations and narrative surrounding Bitcoin’s capped supply of 21 million coins. Timsit noted that historical halving events have typically led to reduced selling pressure from miners and subsequent price increases. He also highlighted the anticipation of bull runs and the significance of the scarcity narrative in influencing market dynamics.

However, the impact of Bitcoin halving goes beyond price speculation. It also raises concerns about the network’s security. The reduction in mining rewards could lead to smaller miners leaving the market, resulting in lower hash rates. Hash rate is a measure of the computational power used to validate and secure transactions on the blockchain. A decreased hash rate theoretically makes Bitcoin more vulnerable to attacks, such as the 51% attack, where a single entity gains control over the majority of mining power and can manipulate the network.

Despite these potential security challenges, Timsit believes that the next Bitcoin halving will further solidify the crypto community’s trust in the reliability of blockchain technology and its governance by immutable code. He described this as a reinforcement of the principle that “code is law,” which is unprecedented in human history.

Additionally, Timsit discussed the positive impact of the Bitcoin halving on adoption and sentiment towards various blockchain networks. He also highlighted the increasing institutional interest in Bitcoin, pointing out regulatory uncertainty as a significant hurdle to wider acceptance and integration of cryptocurrencies.

Timsit suggested that a step towards addressing this challenge would be for countries to require users to adopt regulated crypto exchanges for fiat-to-crypto conversions. This move could help dispel the misconception that Web3 platforms facilitate money laundering.

In conclusion, the crypto expert sees immense opportunities in the advancements of blockchain technology, including faster transactions, lower fees, and a move towards carbon neutrality.

Tomo, a blockchain platform, has secured $3.5 million in seed funding, with Polychain Capital leading the investment round. Additionally, Tomo has introduced Tomoji Launchpad and TomoID to enhance its social wallet experience.

Los Angeles, United States, April 10th, 2024, Chainwire

Innovative Web3 Social Platform Tomo Partners with Industry Leaders, Revolutionizing Social Media Monetization and Engagement

Tomo, an all-encompassing Web3 social application, proudly announces the successful closure of its Seed round funding, led by Polychain Capital. Notable industry leaders such as Consensys, Symbolic Capital, OKX Ventures, Nomad Capital, Story Protocol, dao5, KuCoin Ventures, and HTX Ventures joined as investors. With a focus on integrating financial incentives into social media through blockchain technology, Tomo introduces an evolved social experience with its distinctive offerings: Tomoji – the pioneering ERC-404 Launchpad on Base, and the multifunctional social wallet, TomoID.

Ryan Fang, the founder of Tomo, shared the vision, stating, “We are delighted by the support from our investors, enabling us to innovate in the SocialFi landscape. Tomo’s mission is to pioneer a multichain Web3 Social Wallet that unlocks unique blockchain-enabled opportunities. We aim for a seamless user experience while fostering new ways of connecting, gifting, and creating. Our vision extends to building a platform where every connection is valued, direct, and financially rewarding.”

Expanding its creative horizons, Tomo recently unveiled the ERC404 Meme Launchpad on the Base chain, named Tomoji. Artist Sean Kyah Koons, in collaboration with Tomoji, introduced a premier dragon-themed collection named ‘LONG’ on Tomoji Launchpad. Tomoji facilitates the fractionalization of NFTs, enhancing market liquidity and offering a more flexible approach to ownership. Within the Tomoji launchpad, Tomojis provide seamless minting, gifting, and trading capabilities, offering users an intuitive and interactive platform to engage with digital art. Furthermore, Tomojis are tradable on exchanges.

In continuation, Tomo introduces a new feature, TomoID, alongside a significant funding milestone. TomoID serves as a social wallet designed for content creators and businesses, featuring a link-in-bio tool and an affiliate program for crypto commissions. Users can include their unique TomoID in their social media bios, linking to a page with their profiles across platforms such as Tomo, X, Instagram, TikTok, and more. In conjunction with these innovations, Tomo introduces a reward system in the form of Tomo Points, encouraging active engagement with Tomo’s features and serving as appreciation for the loyalty and contribution of early participants.

Olaf Carlson-Wee, Founder and CEO of Polychain Capital, shared insights on the investment, stating, “At Polychain, we support founders and projects that enable new behaviors. Our investment in Tomo aligns with this philosophy, recognizing Tomo’s role in introducing an immense new user base to the Web3 space. Tomo adds financial incentives to the feedback loops already embedded in social media apps, optimizing the distribution of value created at the intersection of creators and fans.”

Tomo’s application offers accessible onboarding, interactive experiences, and earning opportunities. Tomo creates a transparent marketplace for social capital, where users can engage in authentic and financially rewarding interactions. The platform features a native mobile app for iOS and Android, a Web version beta, account abstraction technology, self-custody, seamless cross-chain bridging, and user-friendly fiat onramp capabilities. Signing up is straightforward with options such as X, Apple (NASDAQ: AAPL), Google (NASDAQ: GOOGL), and Galxe accounts. Tomo simplifies the blockchain introduction by automatically setting up non-custodial wallets using ERC-4337 technology, operating on secure Linea and Base rollups. The ‘Keys’ system in Tomo enables users to purchase unique access to creators’ content and direct messaging. Transactions involving these Keys carry a 10% royalty fee, split evenly between Tomo and the creators, contributing to a sustainable economy. Other features include public stories for key holders, group chats, direct messages, and simple ETH transfers.

Marco Monaco of ConsenSys commented, “Tomo’s SocialFi strategy is not just another ‘bonding curve’ fork. The team focuses on the social aspect with a clear vision and innovative Web3-native ideas. This investment is not just about the team but also about a tech stack that serves as a reference implementation for dApps aiming to bring millions into Web3: mobile app, account abstraction, transparent bridging, self-custody, fiat onramp, and cooperation with the Linea ecosystem. Tomo’s approach marks a significant advancement in the dApps design and demonstrates how SocialFi can empower users and creators.”

About Tomo:

Tomo is an all-inclusive Web3 social application that transforms users’ online presence into a universal social wallet, fostering genuine, spam-free connections, and financial incentives. Tomo allows users to engage directly with creators, participate in private discussions, and explore the new generation of digital art with Tomoji. Active participation earns users Tomo Points, enhancing their social capital. Join Tomo, where your social capital is valued.

Website – https://tomo.inc/

Blog – https://medium.com/tomoinc

Docs – https://docs.tomo.inc/

X (formerly Twitter) – https://twitter.com/tomo_social

Web Beta – https://pro.tomo.inc/

iOS app – https://apps.apple.com/us/app/tomo-inc/id6468010287

Android app – https://play.google.com/store/apps/details?id=tomo.app.unyx

LONG – https://betterbelong.io/

Contact PR Manager Milena Repa Tomomilena@tomo.inc

Featured Hong Kong is reportedly on the verge of approving its first spot Bitcoin exchange-traded funds (ETFs) in April, according to sources.

By Summer Zhen and Jason Xue

HONG KONG (Reuters) – Spot Bitcoin exchange-traded funds (ETFs) are poised for launch in Hong Kong this month, with the first approvals expected to be announced next week, according to two individuals familiar with the matter.

This timeline would position Hong Kong as Asia’s pioneer in offering these popular ETFs, significantly quicker than the industry’s anticipation of launches sometime this year.

One of the sources indicated that regulators have expedited the approval process.

Amid a loss of its luster as a global financial hub due to pandemic-related restrictions, China’s economic challenges, and Sino-U.S. tensions, Hong Kong authorities have been eager to enhance the city’s appeal for financial trading.

“The significance of Hong Kong ETFs is far-reaching as it could bring in fresh global investment as well as pushing crypto adoption to a new height,” said Adrian Wang, CEO of Metalpha, a Hong Kong-based crypto wealth manager.

In January, the U.S. introduced the first U.S.-listed exchange-traded funds (ETFs) to track spot Bitcoin, attracting approximately $12 billion in net inflows, according to data from BitMEX Research.

Bitcoin has surged by more than 60% this year, reaching an all-time high of $73,803 in March. On Wednesday, it was trading around $69,000.

At least four mainland Chinese and Hong Kong asset managers have submitted applications to launch these ETFs, as per the two sources.

China Asset Management, Harvest Fund Management, and Bosera Asset Management, through their Hong Kong units, are among the applicants, the two individuals and a third source mentioned.

The sources, not authorized to speak to the media, declined to be identified.

Hong Kong’s Securities and Futures Commission (SFC) and the three Chinese companies mentioned declined to provide comments.

This month, China Asset Management and Harvest Fund Management’s Hong Kong units received approval to manage portfolios investing more than 10% in virtual assets, according to the SFC’s website.

Their parent companies are prominent mutual fund firms in China, each managing over 1 trillion yuan ($138 billion) in assets.

Despite cryptocurrency trading being prohibited in mainland China, offshore Chinese financial institutions have displayed interest in engaging with crypto asset development in Hong Kong.

Hong Kong endorsed its initial ETFs for cryptocurrency futures in late 2022. The largest among these, the CSOP Bitcoin Futures ETF, has witnessed its assets under management expand sevenfold since September to approximately $120 million.

Value Partners, based in Hong Kong, has also mentioned exploring the launch of a spot Bitcoin ETF. However, it has not disclosed if it has submitted an application.

($1 = 7.2305 yuan)

The SEC has cautioned Uniswap Labs about potential enforcement actions.

The U.S. Securities and Exchange Commission (SEC) has alerted Uniswap Labs, the primary developer of one of the world’s largest cryptocurrency exchanges, of potential enforcement action, as stated in a blog post on Wednesday.

The specific reason for the SEC’s warning to Uniswap was not immediately clarified in the blog post, but it is likely related to the regulator’s efforts to apply U.S. securities law to companies in the digital asset space, similar to Coinbase (NASDAQ: COIN).

The SEC chose not to provide a comment regarding the blog post.

The SEC’s dispute with Coinbase, the largest publicly traded cryptocurrency exchange globally, revolves around a central argument: whether digital assets should be considered investment contracts resembling stocks or bonds, thus falling under SEC regulation.

“In light of the SEC’s continued legal actions against Coinbase and other entities, combined with their outright refusal to offer clarity or a pathway to registration for those operating lawfully within the U.S., we can only infer that this is another political move to target even the most reputable entities developing technology on blockchains,” the blog post stated.

Uniswap serves as a cryptocurrency marketplace for developers, traders, and liquidity providers involved in decentralized finance (DeFi). DeFi operates on an open network, functioning on a peer-to-peer system where transactions bypass centralized entities such as banks or brokerages.

Nektar Network has been introduced to enhance Ethereum’s trust layer and address the issue of centralization.

Berlin, Germany, April 11th, 2024, Chainwire

Nektar Network, a sophisticated re-staking network, has been introduced to optimize Ethereum’s security model and facilitate the scalability of distributed solutions, aiming to foster a more decentralized infrastructure.

The team behind Diva Staking has unveiled the Nektar Network, an innovative re-staking ecosystem set to redefine Ethereum’s trust model and broaden its utility across distributed systems. With its launch, the Nektar Network envisions democratizing Ethereum’s validation process while confronting the challenges posed by centralization and resilience.

Pioneered by EigenLayer and boasting $14 billion in re-staked ETH, re-staking involves repurposing staked assets to secure additional tasks or duties, with validators using these assets as collateral. Users now have the option to participate in Nektar to enhance their staking endeavors, earning extra rewards from AVSs.

Nektar Network addresses pivotal challenges within the blockchain sphere by empowering various agents. It facilitates the seamless establishment of PoS-based distributed systems, bolstering trust and security for applications leveraging its services.

The cryptocurrency ecosystem is swiftly evolving into a more sophisticated and mature landscape, requiring specialized actors crucial for the network’s smooth bootstrapping. The Nektar Community is poised to grow rapidly with their assistance, becoming one of Ethereum’s most significant entities.

Nektar Network emerges as a response to Ethereum’s growing centralization issue. As concerns mount about a restricted number of entities controlling the validation layer, there was a clear need, particularly in the realm of re-staking, for viable alternatives to diversify the burgeoning interest. Nektar Network aims to position itself as the most resilient option within this critical aspect of Ethereum’s scaling.

Additionally, the integration of Distributed Validation Technology (DVT) within Nektar enhances Ethereum’s resilience, providing a robust infrastructure for developers, operators, and validators to securely and efficiently interact with the Ethereum network.

Ethereum’s ecosystem has reached a pivotal moment. While liquid staking has democratized access to Ethereum validation, it has also introduced a centralization challenge where a select few entities could potentially collude to control the network. Continuing on this trajectory would go against Ethereum’s core principles and miscommunicate its values to stakeholders. Nektar offers a re-staking network as decentralized as possible, empowered by DVT.

For more information, users can visit the Nektar Network website.

Media inquiries

Redhill (on behalf of Nektar Network)

Contact: Tien Ma

Email: tien@redhill.world

About Nektar Network

Nektar Network is a sophisticated re-staking network built on the Ethereum platform. It comprises components that collectively form a comprehensive incentives system designed to democratize access to Ethereum’s trust model.

For additional details about Nektar Network, users can visit the official website or follow updates on Farcaster and X.

About Diva Staking

Established in 2023, Diva Staking is the company behind Distributed Validator Technology (DVT). It aims to enhance Ethereum staking decentralization through its proprietary DVT solution, balancing the interests of stakers and operators. In January 2023, Diva Staking secured $3.5 million in seed funding from A&T Capital, OKX Ventures, Alphemy Capital, and Metaweb Ventures, among others.

Featured Bankman-Fried Receives 25-Year Sentence for FTX Fraud Involving Billions of Dollars

Sam Bankman-Fried, the former billionaire wunderkind and founder of the bankrupt FTX cryptocurrency exchange, received a 25-year prison sentence from a judge on Thursday for embezzling $8 billion from FTX customers. U.S. District Judge Lewis Kaplan delivered the verdict at a Manhattan court hearing, dismissing Bankman-Fried’s assertion that FTX customers did not suffer losses and finding him guilty of seven counts of fraud and conspiracy related to FTX’s collapse in 2022, a case labeled by prosecutors as one of the largest financial frauds in U.S. history.

Judge Kaplan remarked that Bankman-Fried displayed no remorse, stating, “He knew it was wrong… He knew it was criminal.” Bankman-Fried, 32, clad in a beige short-sleeve jail T-shirt, addressed the court for about 20 minutes, expressing regret for the suffering of FTX customers and extending an apology to his former colleagues at FTX, though he did not admit to criminal wrongdoing. He declared plans to appeal his conviction and sentencing.

This verdict marks the climax of Bankman-Fried’s downfall from an immensely wealthy entrepreneur and significant political donor to a prominent target in the U.S. crackdown on misconduct in cryptocurrency markets. U.S. Attorney General Merrick Garland emphasized the seriousness of defrauding customers and investors, cautioning against the belief that financial crimes can be shielded by wealth and influence.

Judge Kaplan’s ruling found that FTX customers lost $8 billion, with equity investors of FTX losing $1.7 billion, and lenders to Bankman-Fried’s Alameda Research hedge fund losing $1.3 billion. He issued an $11 billion forfeiture order and authorized the government to reimburse victims using seized assets.

Federal prosecutors had initially sought a 40 to 50-year sentence, while Bankman-Fried’s defense, led by Marc Mukasey, argued for less than 5-1/4 years.

In his address to the court, Bankman-Fried expressed remorse, stating, “Customers have been suffering… I didn’t intend to downplay that.” He also acknowledged the loss experienced by his FTX colleagues, recognizing the impact of his actions on their efforts. Three former associates, testifying as prosecution witnesses, revealed Bankman-Fried’s direction to utilize FTX customer funds to cover losses at Alameda Research, all of whom have pleaded guilty to fraud.

Judge Kaplan pointed out Bankman-Fried’s falsehoods during his trial testimony regarding his knowledge of Alameda Research’s use of customer deposits from FTX.

Mukasey sought to differentiate Bankman-Fried from infamous fraudsters such as Bernie Madoff, describing him as an “awkward math nerd” rather than a “ruthless financial serial killer.” Mukasey emphasized Bankman-Fried’s intent to return customers’ money following FTX’s collapse.

Bankman-Fried, visibly emotional, listened to Mukasey’s statements with reddened eyes, appearing to hold back tears. Following the proceedings, he was escorted out of the courtroom by U.S. Marshals after a brief discussion with his defense team.

The sentencing also highlighted Bankman-Fried’s rise from a Massachusetts Institute of Technology graduate to a Forbes-listed billionaire by age 30, known for his dedication to effective altruism and substantial contributions to political causes. Judge Kaplan underscored evidence of Bankman-Fried’s donations to both Democratic and Republican candidates, noting his attempt to conceal contributions through “straw” donors.

In a concluding statement, the judge characterized Bankman-Fried’s portrayal of himself as a “good guy” as a facade, citing “power and influence” as his underlying motives.

Bankman-Fried has been held at the Metropolitan Detention Center in Brooklyn since August 2023, following the revocation of his bail by Judge Kaplan due to suspected witness tampering on two occasions. Kaplan indicated that he would recommend Bankman-Fried serve his sentence at a prison facility near San Francisco.

Featured JPMorgan Report Indicates Increased Profitability Predicted for Bitcoin Mining Prior to Halving

In March 2024, the Bitcoin mining sector experienced significant growth, driven by the surge in cryptocurrency prices to all-time highs, leading to an increase in mining profitability, as outlined in a JPMorgan report.

The analysis comes at a critical juncture as the industry prepares for the upcoming Bitcoin halving event scheduled for April 16, 2024, which is anticipated to impact miners’ rewards and overall profitability.

Bitcoin’s price surged to an average of nearly $67,600 in March, reaching its highest historical level, and closed the month with a seven-day rolling average price of around $69,900. This rise in price represents a 25% increase from the previous month, with the annualized volatility rising to 65% in March from 42% in February.

During March, the network’s average daily hashrate, which measures the computational power utilized for mining and processing transactions, hit a new milestone of 600 EH/s (exahash per second). This figure indicates a 4% rise from February and an impressive 80% year-over-year growth. The uptick in hashrate signifies not only heightened competition among miners but also reflects the industry’s resilience and positive outlook, as highlighted in the report.

Despite these encouraging trends, the impending Bitcoin halving event, where the block reward will reduce from 6.25 to 3.125 bitcoins, introduces uncertainty regarding future mining profitability. The JPMorgan report suggests that the halving could potentially lead to a decline in profitability in April unless offset by a substantial rally in Bitcoin’s price or a significant decrease in the network’s hashrate.

In March, the estimated average daily block reward revenue per exahash for miners reached $100,400, marking the highest level since August 2022 and representing a 33% sequential increase. This surge in profitability was attributed to the appreciation in Bitcoin’s price outpacing the growth rate of the network’s hashrate.

The report also delved into the performance of U.S.-listed Bitcoin mining firms, noting that the aggregate market capitalization of the 14 tracked miners rose by 3% month-over-month to $20 billion. According to JPMorgan’s calculations, this figure represents 42% of the four-year revenue opportunity.

Among the listed companies, Cipher Mining Inc (NASDAQ:CIFR) emerged as the top performer with a 74% increase, while Bitfarms Ltd (NASDAQ:BITF) experienced a decline of 22%, making it the least favorable stock of the month.

US Authorities Transfer Bitcoin Confiscated from Silk Road, Fueling Speculation of Potential Sale

A U.S. government-controlled account, holding nearly $2 billion worth of Bitcoin seized from the now-defunct dark web marketplace Silk Road, initiated a series of transactions on Tuesday, sparking speculation about a potential sale of these digital assets, according to reports from multiple blockchain analytics firms.

The account conducted a minor transaction of around $65 to a deposit address at Coinbase Global Inc.’s Coinbase Prime unit, as observed by Arkham Intelligence Inc.

On the whole, transfers totaling approximately $131 million were recorded going to Coinbase on Tuesday, with a significant portion of these funds then redirected to other addresses associated with the U.S. government, as per the firm’s analysis.

Analysts noted that the $65 transaction appeared to be a test transaction from the U.S. government.

“The small amount is being sent to Coinbase Prime, while the large amount is being credited back to the U.S. government as a ‘change output.’ Most likely, they will follow up by sending a larger (possibly the full) amount to Coinbase Prime, having confirmed the test transaction arrived at its intended destination.”

Subsequent transactions showed approximately 2,000 Bitcoin being consolidated from various government addresses and transferred to Coinbase, according to Flipside Crypto.

While digital wallets generally maintain anonymity, these transactions are closely monitored by market participants due to their potential impact on Bitcoin’s market price.

The U.S. government has previously sold portions of its Silk Road Bitcoin holdings, often through auctions. The account involved in Tuesday’s transactions originally held 30,174 Bitcoin.

The Silk Road platform, shut down by the government in 2013, allowed users to purchase illicit goods such as narcotics and counterfeit documents using BTC.

At the time of the platform’s closure, federal agents seized Bitcoin valued at $3.6 million, a figure that has since soared to billions of dollars due to the cryptocurrency’s surge in value.

Byte Federal Introduces Point of Sale Solution for Merchants Embracing Bitcoin Acceptance

Venice, Florida, April 3rd, 2024, Chainwire

Byte Federal, a prominent player in the global financial technologies sector, is pleased to announce the official rollout of its point of sale (POS) system, ByteConnect. This launch signifies a significant expansion of Byte Federal’s offerings in the fintech realm, demonstrating a commitment to developing a comprehensive suite of financial tools for economic empowerment.

Lennart Lopin, co-founder, and CTO of Byte Federal, shared the vision driving this innovative venture: “A solid financial foundation is crucial for creators and visionaries, propelling societal advancement. We are thrilled to introduce Bitcoin to the world—a groundbreaking innovation that fosters freedom and nurtures creativity within global communities.”

Following a successful beta testing phase, Byte Federal’s merchant POS system is now available across most regions of the United States. In states where Byte Federal holds a Money Transmitter License (MTL), additional merchant services are being offered, with plans for further expansion as additional licenses are secured.

The new suite of merchant products includes a robust API, a physical handheld POS device tailored for retail establishments, and a range of digital e-commerce solutions. Byte Federal is enthusiastic about its role in the next stage of Bitcoin adoption.

“There is a growing demand for innovative tools that enable transactions outside the constraints of traditional financial systems, and these are the tools we are developing,” remarked Michelle Weekley, Director of Product Development at Byte Federal.

The launch of Byte Federal’s merchant POS system represents not only a milestone for the company but also a significant advancement in the global cryptocurrency landscape.

Kenneth Shortrede, Senior Software Engineer at Byte Federal, highlighted the global implications: “Observing the challenges faced by merchants in Argentina—ranging from inflation to conventional payment obstacles such as delays and high fees—underscores the necessity for a superior system. A decentralized Bitcoin-based solution could facilitate faster and more cost-effective global transactions for merchants.”

Headquartered in Florida, Byte Federal boasts a dedicated team offering expert integration support to merchants seeking to broaden their payment horizons.

About ByteFederal

ByteFederal is committed to reshaping economic dynamics through cryptocurrency, empowering individuals to build wealth through our innovative software solutions. Our mission champions the concept of sound money, liberated from central control, fostering an environment where free trade and genuine capital growth flourish. Drawing inspiration from historical progress and the potential of Bitcoin, we strive to enhance individual purchasing power and pave the way for a future where economic freedom and innovation reign supreme.

We are building a future where peer-to-peer financial services create a transparent, efficient economy, enabling personal prosperity and securing a brighter tomorrow.

Empowering prosperity with the principles of sound money. Join us.

Contact:

Director of Product Development Michelle Weekley Byte Federal Email: michelle@bytefederal.com