A prediction suggests that the Bitcoin bull market could make a comeback following a $1.4 trillion liquidity injection in the US.

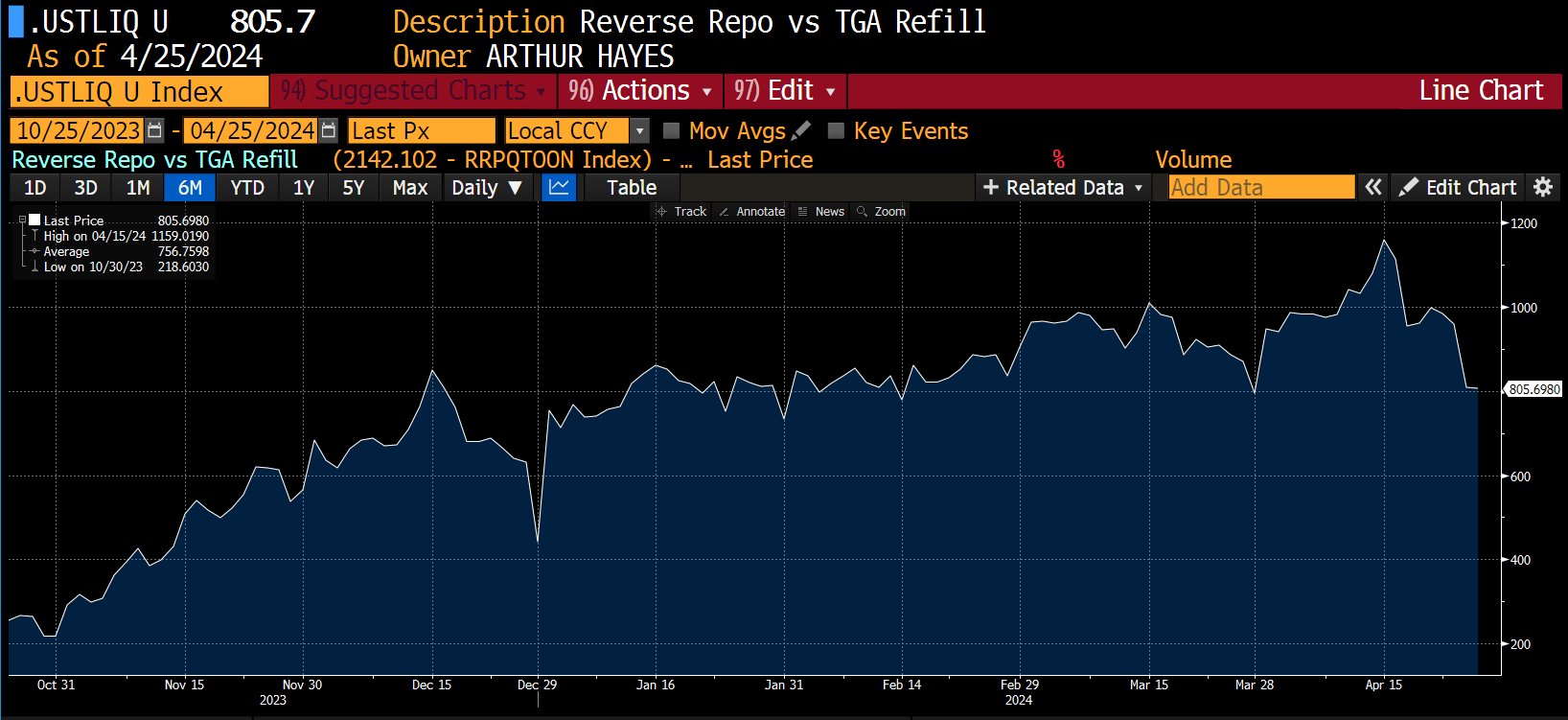

Arthur Hayes suggests that the Federal Reserve dropping interest rates to attract more liquidity into the economy is increasingly unlikely. Instead, he believes that Treasury Secretary Janet Yellen is the key figure to watch. On April 29, the U.S. Treasury will release the quarterly refunding documentation, outlining how the government will manage liquidity. Two significant liquidity sources to monitor are the Treasury General Account (TGA) and Reverse Purchase Agreements (RRPs). According to Hayes, tax receipts have added approximately $200 billion to the TGA, indicating potential liquidity implications.

Hayes suggests that draining either the Treasury General Account (TGA) or funds from Reverse Purchase Agreements (RRPs) can stimulate the economy, which is crucial for the performance of risk assets, including cryptocurrencies. He argues that the focus should be on Janet Yellen, as part of a theory suggesting that the printing of U.S. dollars will accelerate leading up to and after the upcoming Presidential Election.

Hayes outlines potential scenarios, such as a $1 trillion drain from the TGA, $400 billion in RRPs, or a combination of both, resulting in a possible $1.4 trillion liquidity injection into the economy. In summary, Hayes emphasizes that while the Federal Reserve may be considered irrelevant in this context, Janet Yellen’s influence is significant, and she should be respected for her role in shaping economic policy.

Bitcoin ETFs see “overdue” slowdown

Some observers believe that Bitcoin’s increasing adoption among mainstream investors will have a positive impact on its price, creating a feedback loop. However, Arthur Hayes predicts that the Bitcoin halving event will trigger a significant sell-off of various crypto assets.

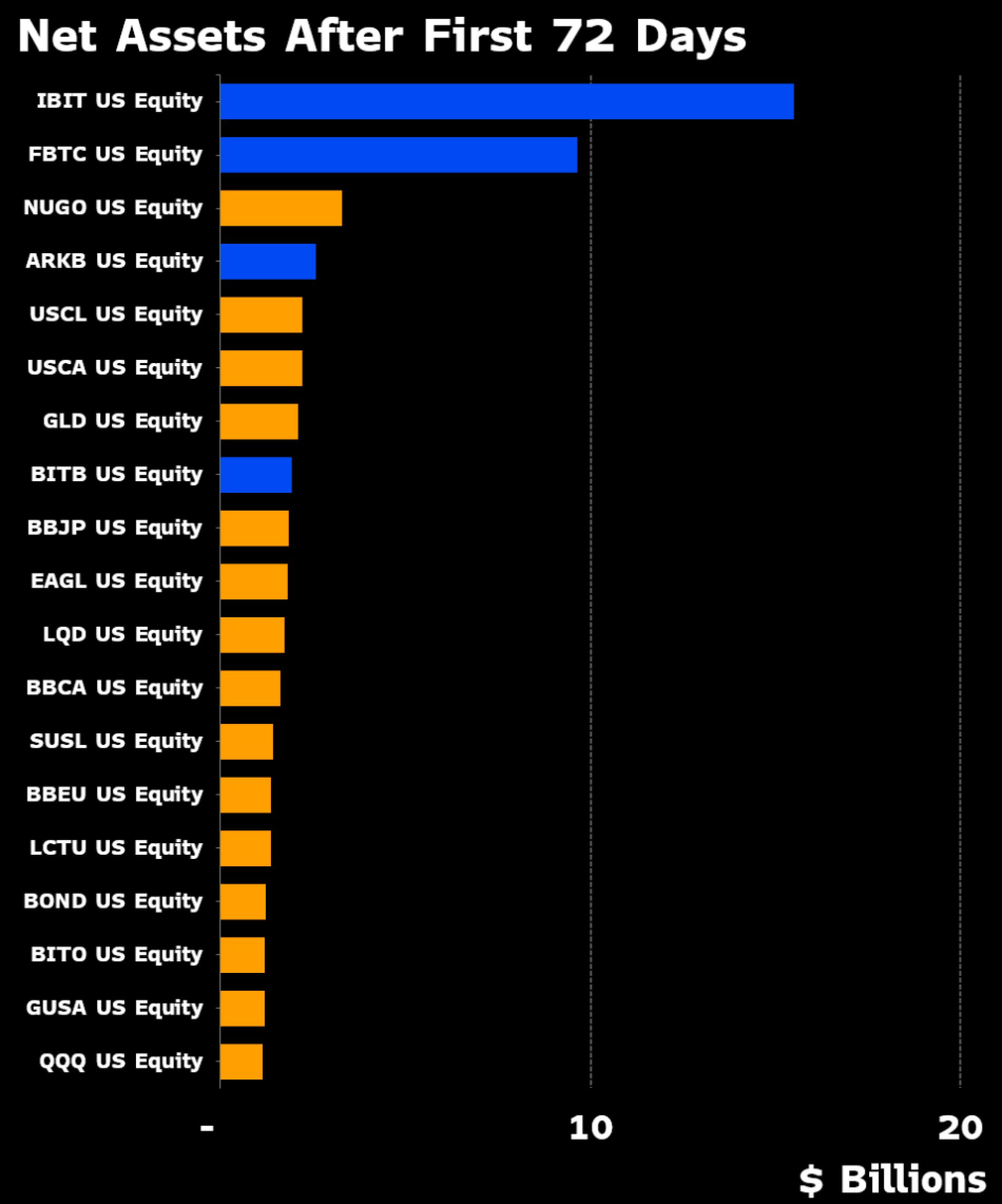

Despite the historic success of the debut of U.S. spot Bitcoin exchange-traded funds (ETFs), they have yet to reach their full potential audience. Eric Balchunas, an ETF analyst at Bloomberg, commented on BlackRock’s iShares Bitcoin Trust (IBIT), the largest product by assets under management excluding the Grayscale Bitcoin Trust (GBTC). He downplayed concerns about a recent decrease in inflows, noting that while IBIT’s streak of daily inflows ended after 71 days, it continues to set records. Balchunas shared Bloomberg data comparing ETF assets after the first 72 days on the market, highlighting IBIT’s continued success.

He added that “out of all the 10,698 registered funds in the U.S. (incl ETFs, mutual funds, CEFs) $IBIT currently ranks 2nd in YTD flows.”

While overall allocations remain small thus far, Cathie Wood, CEO of one spot Bitcoin ETF provider, ARK Invest, sees the trend gathering speed.

Leave a Reply