Pension Fund Entices Investors with Remarkable 10-15% Monthly Returns in Crypto Investments

In an unprecedented move, a pension fund has captivated the attention of investors by offering seemingly irresistible returns of 10-15% per month through investments in cryptocurrencies. This bold promise, devoid of any mention of risk, has sparked curiosity and enthusiasm among retirees seeking to maximize their retirement savings.

Pension Fund Revolutionizes Retirement Investing

The pension fund’s groundbreaking initiative aims to revolutionize retirement investing by harnessing the potential of cryptocurrencies to deliver unparalleled returns without exposing investors to risk. With the allure of double-digit monthly returns, retirees are drawn to the prospect of accelerating their wealth accumulation and securing a more comfortable retirement.

Crypto Investments: A Path to Financial Freedom

Cryptocurrencies have long been hailed as a gateway to financial freedom, offering investors the opportunity to capitalize on the explosive growth of digital assets. With the pension fund’s innovative approach to crypto investing, retirees can now access the lucrative potential of digital currencies without the complexities and uncertainties typically associated with the market.

Unprecedented Returns, Unrivaled Opportunity

The promise of 10-15% monthly returns represents an unprecedented opportunity for retirees to significantly boost their retirement savings and achieve their financial goals with ease. By harnessing the power of cryptocurrencies, the pension fund aims to empower investors with a pathway to wealth accumulation that was once thought to be out of reach.

Changing the Retirement Landscape

The pension fund’s bold venture into crypto investments marks a paradigm shift in the retirement landscape, challenging traditional notions of investment risk and return. With a focus on delivering consistent and substantial returns, the fund is poised to redefine retirement investing for a new generation of investors seeking financial security and prosperity.

Empowering Investors for the Future

As retirees flock to take advantage of the pension fund’s revolutionary offering, they are embarking on a journey towards financial empowerment and independence. With the potential for exponential growth through crypto investments, investors can take control of their financial future and unlock new possibilities for wealth creation.

A New Era of Retirement Investing

The emergence of the pension fund’s crypto investment strategy heralds a new era of retirement investing, one characterized by unprecedented returns and unparalleled opportunity. As retirees embrace the potential of cryptocurrencies to transform their financial outlook, they are paving the way for a brighter and more prosperous future.

Looking Ahead: A Future of Financial Abundance

As the pension fund’s crypto investment initiative gains traction, retirees are poised to reap the rewards of their bold investment decisions. With the potential for 10-15% monthly returns, investors can look forward to a future of financial abundance and security, free from the constraints of traditional investment models.

Embracing the Crypto Revolution

With the pension fund leading the charge, retirees are embracing the crypto revolution with open arms, eager to seize the extraordinary opportunities presented by digital assets. As the world of cryptocurrencies continues to evolve, investors can rest assured that their retirement savings are in capable hands, poised for exponential growth and prosperity.

Banks Caught in Cryptocurrency Conundrum: Opposing Yet Investing in Digital Assets

In a perplexing turn of events, traditional banks find themselves at odds with the rise of cryptocurrencies, decrying the digital assets while quietly investing in them behind closed doors. This apparent contradiction highlights the complex relationship between traditional financial institutions and the burgeoning crypto market, raising questions about their motives and strategies in navigating the evolving landscape of digital finance.

Banks’ Opposition to Crypto: A Battle for Control

For years, traditional banks have viewed cryptocurrencies with skepticism, citing concerns over volatility, regulatory uncertainty, and the potential for illicit activities. Many financial institutions have been vocal in their opposition to digital assets, warning customers against investing in what they perceive as speculative and risky ventures.

Behind this outward resistance, however, lies a deeper struggle for control and relevance in the rapidly changing financial landscape. Cryptocurrencies represent a paradigm shift away from traditional banking models, offering decentralized, borderless, and permissionless financial services that challenge the status quo of the banking industry.

A Closer Look at Banks’ Investments in Crypto

Despite their public skepticism, banks have been quietly dipping their toes into the crypto waters, investing in digital assets and blockchain technology through various channels. Some banks have established dedicated cryptocurrency trading desks, offering services to institutional clients interested in exposure to digital assets.

Additionally, several banks have invested in cryptocurrency-related companies and startups, recognizing the potential for innovation and disruption within the blockchain ecosystem. These investments, while often kept under wraps, underscore banks’ recognition of the value and transformative potential of cryptocurrencies and blockchain technology.

Navigating Regulatory Uncertainty

One of the primary reasons behind banks’ outward opposition to cryptocurrencies is the regulatory uncertainty surrounding the digital asset space. Concerns over compliance, money laundering, and consumer protection have led many banks to adopt a cautious approach to engaging with cryptocurrencies.

However, as regulatory frameworks evolve and mature, banks are increasingly exploring ways to integrate cryptocurrencies into their existing operations. Some banks have begun offering custody services for digital assets, while others are exploring the possibility of launching their own digital currencies or blockchain-based payment systems.

Striking a Balance: Embracing Innovation While Mitigating Risks

The dual stance of banks regarding cryptocurrencies reflects a delicate balancing act between embracing innovation and mitigating risks. While banks recognize the potential for disruption posed by cryptocurrencies, they also face pressure to protect their existing business models and comply with regulatory requirements.

As the crypto market continues to evolve and mature, banks are likely to reassess their strategies and approaches to digital assets. While some may continue to resist the rise of cryptocurrencies, others are expected to embrace the opportunities presented by blockchain technology and digital finance.

The Future of Banking in the Crypto Era

The contradictory stance of banks regarding cryptocurrencies underscores the seismic shift underway in the financial industry. As digital assets gain mainstream acceptance and adoption, traditional banks are being forced to adapt to a new reality where decentralized finance and blockchain technology play a central role.

The future of banking in the crypto era is likely to be shaped by innovation, collaboration, and competition. Banks that embrace the opportunities presented by cryptocurrencies and blockchain technology stand to thrive in the digital age, while those that cling to outdated models risk being left behind in the evolving financial landscape.

PropyKeys Onboards 150k Addresses Onchain

Miami, FL, April 26th, 2024, Chainwire

PropyKeys sees 150k addresses minted onchain just weeks after the platforms launch marking rapid growth and adoption

PropyKeys, a pioneering ecosystem project within the Propy ecosystem, has facilitated the minting of over 150,000 real estate addresses or landmarks as Non-Fungible Tokens (NFTs) onchain. PropyKeys has created an onchain database with the ambition to onboard one million home addresses worldwide. The project is estimated to bring real estate assets worth $10 billion onchain.

PropyKeys has rapidly gained momentum and successfully scaled to meet demand, with over 150,000 minted addresses achieved since the launch on March 13th. This remarkable growth underscores the enthusiasm and interest within the real estate and web3 communities for innovative solutions to secure their property rights onchain.

The recent high-profile launch event, which featured prominent guest speakers such as Cathie Wood, Tim Draper, and Anthony Pompliano, was an exciting showcase of the significance that PropyKeys represents at the intersection of real estate and blockchain technology, receiving significant endorsement from key industry leaders.

“PropyKeys represents a monumental step towards democratizing access to real estate ownership through blockchain technology.” Andrew Zapo, COO of PropyKeys. “Our platform not only provides an innovative solution that stands to drastically improve security, efficiency, and access all while empowering individuals worldwide to participate in the digital real estate revolution.”

PropyKeys Leads with Crypto-Native Real Estate Solutions

Incorporating engaging gamification elements, PropyKeys has attracted thousands of participants to daily challenges, fostering a vibrant and interactive ecosystem. The project has also curated a global landmark AI NFT collection, leveraging the transition of real estate onto the blockchain. The recent sale of collection artifacts, conducted in partnership with Rarible, includes iconic landmarks like Central Park, Westminster Abbey, and the Verona Arena.

In the run up to 150k, Propy also integrated Chainlink Automation, a decentralized service designed to manage tasks for smart contracts to ensure reliable and economically incentivized automation, onto the platform to distribute staking rewards. Notable features include highly reliable and performant automation, cost-saving infrastructure, scalability, and the unlocking of new use cases to ensure the best and most secure possible user experience.

Tokenized Real Estate for a New Generation of Owners

PropyKeys is built on Base Network and accepts $PRO, Propy’s native token, providing users with flexibility in minting on Ethereum mainnet or Base. Additionally, the platform offers US users the ability to mint their deeds onchain, addressing concerns about deed fraud and ensuring ownership security. With its rapid growth, strategic partnerships, and commitment to innovation, PropyKeys is poised to revolutionize the way buyers, sellers, owners, and agents operate in the real estate market, opening it up to new participants while making it more secure than ever before.

About PropyKeys:

PropyKeys, a gamified platform within the Propy ecosystem, aims to redefine real estate ownership through blockchain technology. Launched in March 2024 on Base, PropyKeys allows users to mint digital addresses and deeds for real-world properties. With features like AI-generated landmark NFT minting and a novel staking mechanism, PropyKeys is setting new standards for property ownership in the digital age.

Contact: patrick@serotonin.co

ContactCOOAndrew ZapoPropyKeysandrew@propykeys.com

MeWe has initiated a Community Invest Round through WeFunder.

MeWe, a decentralized social network operating on the Polkadot blockchain, has launched a Regulation CF (Reg-CF) community investment round on Wefunder, allowing its 20 million users to own a financial stake in the company. Through Wefunder, individual investors can directly invest in startup companies, with MeWe users able to participate in the company’s success for as little as $100.

With a user base spanning over 20 million across 200 countries and territories, and more than 740,000 already active on the blockchain, MeWe aims to lead the transition from Web2 to Web3 on a large scale. By leveraging the vast market potential of social networks and the substantial volume of Web3 transactions, estimated at $1 trillion, MeWe seeks to revolutionize the digital landscape.

By the fourth quarter of 2024, MeWe anticipates surpassing 1.5 million users on-chain. The migration to blockchain technology is designed to provide users with unparalleled privacy, control, and ownership of their digital identities and social interactions.

MeWe’s Chairman and CEO, Jeffrey Edell, expressed the company’s vision for user ownership and decentralized social media. He stated, “Years ago, we envisioned a powerful alternative to Big Tech social media, without the influence of corporations or data brokers, where individuals could own and control their own digital identities and social experiences. As we enter this next chapter, we’re offering our users an opportunity to own a personal stake in the future of MeWe and decentralized social media.”

MeWe’s team is led by accomplished executives from renowned companies such as Disney, Apple, Yahoo!, 21st Century Fox, Myspace, Warner Bros, and Samsung. In February 2022, the company closed a $24 million Series A round led by McCourt Global.

Investment in MeWe is open to everyone, starting from $100 and going up to $500,000 or more through their WeFunder page.

MeWe is a social network prioritizing privacy and empowering users to control their data and social media experience. The company introduced a “Privacy Bill of Rights,” ensuring users have control over their data and news feeds. MeWe offers features like joining groups, engaging with friends, and complete user control without ads or algorithms. With over 20 million users globally and unique features such as the MeWe 2-way camera and voice & video messaging, the platform hosts over 700,000 user-driven interest groups.

MeWe has received recognition, being a Finalist in the 2024 SXSW Innovation Awards, named a 2020 Most Innovative Social Media Company by Fast Company, and recognized as a 2019 Best Entrepreneurial Company in America by Entrepreneur Magazine. In 2016, MeWe was honored as a Start-Up of the Year Finalist for “Innovative World Technology” at SXSW.

For further inquiries, you can contact MeWe’s SVP of Marketing, Michael Huntsman, at michael@mewe.com or 415-696-0098.

Bitcoin price today: pinned at $64k, rate jitters grow before PCE data

On Friday, Bitcoin’s price remained relatively unchanged as sentiment in the crypto markets was dampened by increasing expectations of sustained higher U.S. interest rates. Investors were closely monitoring upcoming U.S. inflation data, which influenced market sentiment.

Bitcoin experienced a modest 0.2% increase over the past 24 hours, reaching $64,339.7 by 01:38 ET (05:38 GMT). Despite this slight uptick, the world’s largest cryptocurrency was poised for a subdued weekly performance, as it remained within a trading range of $60,000 to $70,000 established over the past six weeks.

Concerns about continued regulatory scrutiny on crypto were highlighted this week following reports that U.S. prosecutors were seeking a three-year prison sentence for Binance founder Changpeng Zhao, who pleaded guilty to violating anti-money laundering laws.

The outlook for Bitcoin dimmed as expectations for interest rate cuts by the Federal Reserve diminished. The market largely ignored a decline in the dollar overnight, driven by weaker-than-expected U.S. gross domestic product data. However, a stronger GDP price index reading led traders to scale back expectations for rate cuts by the Fed. According to the CME Fedwatch tool, traders were only pricing in rate cuts by September or the fourth quarter of 2024.

The prospect of higher U.S. interest rates made traders cautious about Bitcoin and other cryptocurrencies, as it reduces the appeal of volatile and speculative assets. Bitcoin typically performs well in low-rate, high-liquidity environments.

Despite positive earnings from tech giants Microsoft Corporation and Alphabet Inc, Bitcoin did not benefit from the strength in U.S. technology stocks. Its correlation with U.S. tech stocks, which had been observed in recent weeks, remained largely negative.

In the broader crypto market, Ethereum experienced a 0.3% decline, while XRP and Solana traded within a narrow range. Investors were closely watching for key U.S. inflation data, particularly the PCE price index for March, which is expected to influence the Federal Reserve’s outlook on interest rates.

A prediction suggests that the Bitcoin bull market could make a comeback following a $1.4 trillion liquidity injection in the US.

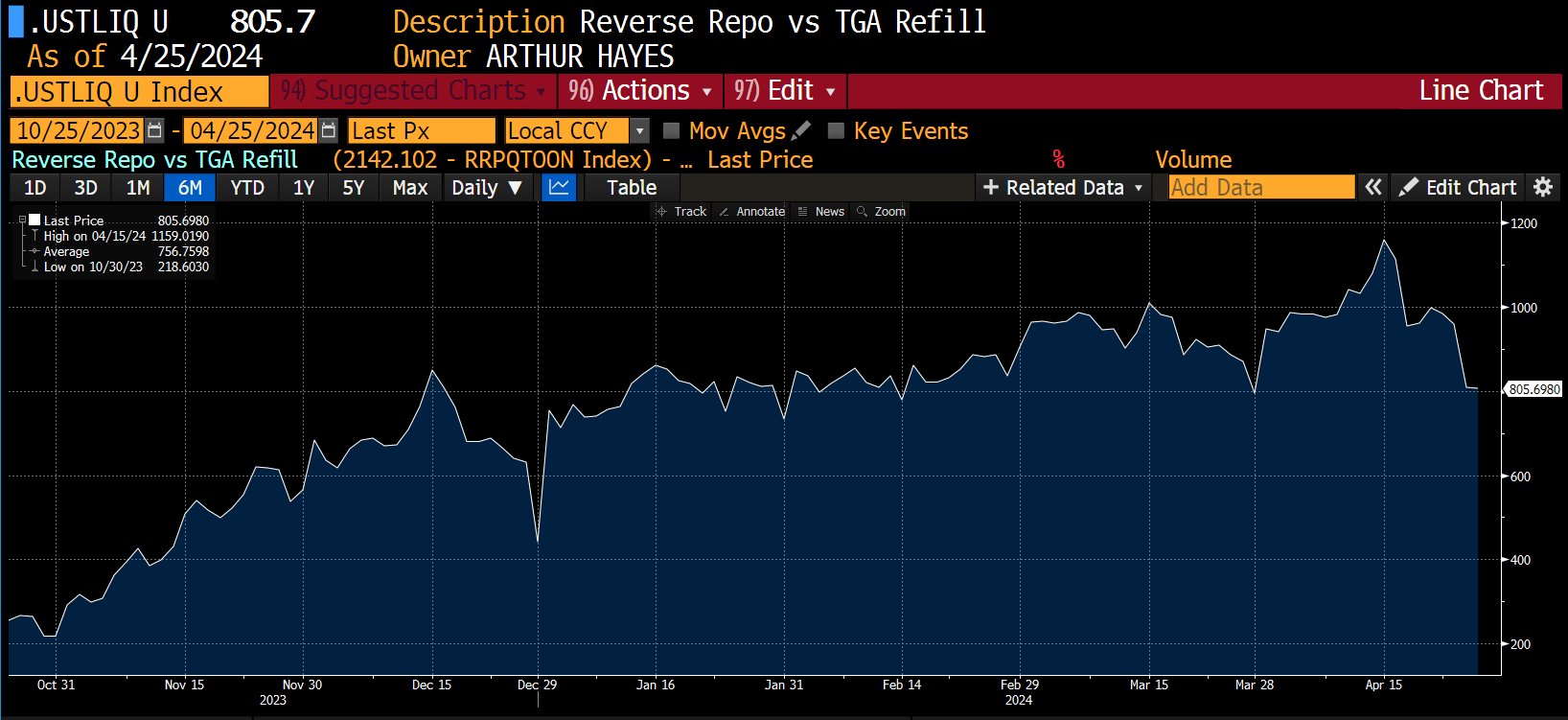

Arthur Hayes suggests that the Federal Reserve dropping interest rates to attract more liquidity into the economy is increasingly unlikely. Instead, he believes that Treasury Secretary Janet Yellen is the key figure to watch. On April 29, the U.S. Treasury will release the quarterly refunding documentation, outlining how the government will manage liquidity. Two significant liquidity sources to monitor are the Treasury General Account (TGA) and Reverse Purchase Agreements (RRPs). According to Hayes, tax receipts have added approximately $200 billion to the TGA, indicating potential liquidity implications.

Hayes suggests that draining either the Treasury General Account (TGA) or funds from Reverse Purchase Agreements (RRPs) can stimulate the economy, which is crucial for the performance of risk assets, including cryptocurrencies. He argues that the focus should be on Janet Yellen, as part of a theory suggesting that the printing of U.S. dollars will accelerate leading up to and after the upcoming Presidential Election.

Hayes outlines potential scenarios, such as a $1 trillion drain from the TGA, $400 billion in RRPs, or a combination of both, resulting in a possible $1.4 trillion liquidity injection into the economy. In summary, Hayes emphasizes that while the Federal Reserve may be considered irrelevant in this context, Janet Yellen’s influence is significant, and she should be respected for her role in shaping economic policy.

Bitcoin ETFs see “overdue” slowdown

Some observers believe that Bitcoin’s increasing adoption among mainstream investors will have a positive impact on its price, creating a feedback loop. However, Arthur Hayes predicts that the Bitcoin halving event will trigger a significant sell-off of various crypto assets.

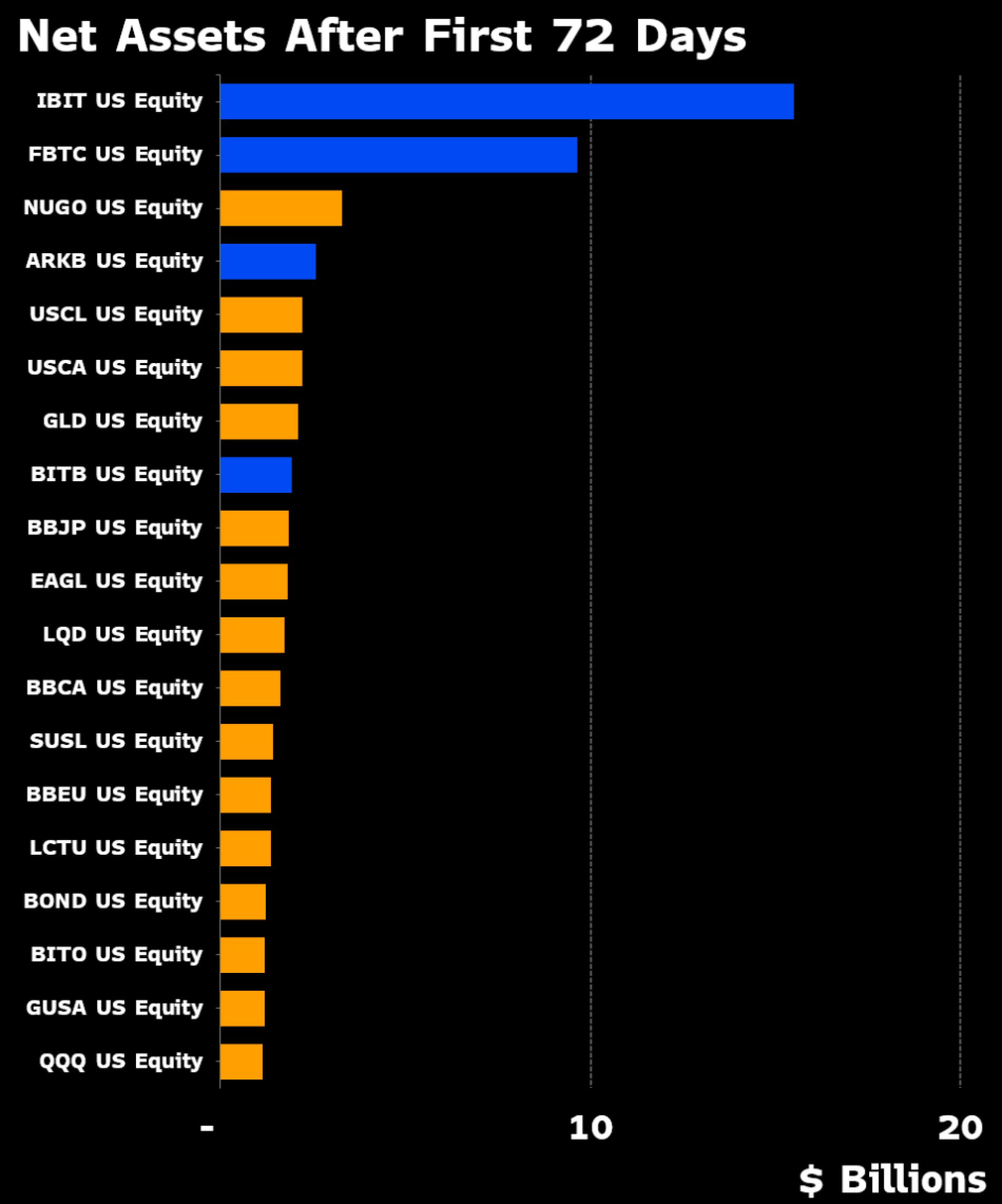

Despite the historic success of the debut of U.S. spot Bitcoin exchange-traded funds (ETFs), they have yet to reach their full potential audience. Eric Balchunas, an ETF analyst at Bloomberg, commented on BlackRock’s iShares Bitcoin Trust (IBIT), the largest product by assets under management excluding the Grayscale Bitcoin Trust (GBTC). He downplayed concerns about a recent decrease in inflows, noting that while IBIT’s streak of daily inflows ended after 71 days, it continues to set records. Balchunas shared Bloomberg data comparing ETF assets after the first 72 days on the market, highlighting IBIT’s continued success.

He added that “out of all the 10,698 registered funds in the U.S. (incl ETFs, mutual funds, CEFs) $IBIT currently ranks 2nd in YTD flows.”

While overall allocations remain small thus far, Cathie Wood, CEO of one spot Bitcoin ETF provider, ARK Invest, sees the trend gathering speed.