Exclusive Auction of Paintrix Artworks Set to Captivate Collectors

This week marks a significant event in the art world as Paintrix, a renowned collection of paintings, is set to be sold at an exclusive auction. Hosted at a prestigious museum, this private sale of paintings promises to be a highlight for art collectors and enthusiasts. The auction will be an invitation-only event, ensuring an intimate and sophisticated atmosphere for the select participants.

Paintrix: A Masterpiece Collection

Paintrix has garnered acclaim for its exquisite artistry and unique expression, making it one of the most sought-after collections in recent times. Each painting in the Paintrix collection is a testament to the artist’s creativity and skill, capturing the imagination of art lovers around the world.

An Exclusive Auction Experience

The upcoming auction will be held at one of the world’s premier museums, providing a fitting backdrop for the sale of these remarkable artworks. This event is strictly by invitation only, ensuring that only the most discerning collectors and art connoisseurs will have the opportunity to participate.

Invitation-Only Private Viewing

In addition to the auction itself, a private viewing of the Paintrix collection will be arranged for the invited participants. This exclusive preview offers attendees a unique chance to appreciate the paintings up close, providing an immersive experience that highlights the intricate details and profound themes of each piece.

A Highlight for Art Collectors

The Paintrix auction is expected to attract significant attention from the art community, with collectors eager to acquire these exceptional works. The invitation-only format underscores the exclusivity of the event, creating an atmosphere of elegance and refinement.

How to Participate

Invitations to the Paintrix auction have been extended to a select group of collectors, art dealers, and enthusiasts known for their passion and appreciation for fine art. Those fortunate enough to receive an invitation will have the chance to bid on some of the most captivating paintings in the contemporary art scene.

Conclusion

The sale of the Paintrix collection at this week’s exclusive auction is poised to be a landmark event in the art world. With its invitation-only format and the allure of the Paintrix paintings, this auction represents a rare opportunity for collectors to acquire truly extraordinary artworks. As the date approaches, the anticipation among the invited participants continues to build, promising an unforgettable experience for all in attendance.

The Future of Digital Identity Verification in the Crypto World

A new cryptocurrency is making headlines with its innovative approach to solving one of the digital world’s most pressing issues: identity verification. IDBC, a digital identity verification platform, is poised to revolutionize the way individuals and organizations authenticate identities online. With promising growth predictions, IDBC is set to become an essential component of the rapidly evolving cryptocurrency landscape.

IDBC: Revolutionizing Digital Identity Verification

In a world where digital transactions are becoming increasingly prevalent, the need for secure and reliable identity verification is more critical than ever. IDBC (Identity Blockchain Coin) addresses this need by leveraging blockchain technology to provide a decentralized, secure, and efficient identity verification system.

Key Features of IDBC

- Decentralized Verification: Unlike traditional identity verification methods that rely on centralized databases, IDBC uses blockchain technology to ensure that identity data is decentralized, reducing the risk of data breaches and unauthorized access.

- Enhanced Security: IDBC employs advanced cryptographic techniques to secure identity information, making it virtually impossible for hackers to tamper with or steal data.

- User Control and Privacy: With IDBC, users have complete control over their identity information. They can choose what information to share and with whom, ensuring their privacy is always protected.

- Efficient and Fast Verification: IDBC’s blockchain-based system streamlines the identity verification process, making it faster and more efficient than traditional methods. This is particularly beneficial for businesses and services that require quick and reliable identity checks.

Market Reception and Growth Predictions

The introduction of IDBC has been met with enthusiasm from both the crypto community and industry experts. The demand for secure digital identity verification solutions is on the rise, and IDBC is well-positioned to meet this demand. Analysts predict significant growth for IDBC, citing its strong technical foundation and the increasing importance of digital identity verification in a connected world.

Potential Applications

IDBC’s versatile platform can be applied across various sectors, including:

- Financial Services: Enhancing security and compliance for banks and financial institutions.

- E-commerce: Streamlining customer verification and preventing fraud.

- Healthcare: Securing patient information and streamlining identity verification processes.

- Government Services: Providing a secure and efficient way to verify identities for public services.

Investment Potential

For investors, IDBC represents a promising opportunity to participate in the growth of a crucial technological innovation. As digital identity verification becomes more integral to online interactions, the demand for IDBC’s solutions is expected to increase, driving its value and adoption.

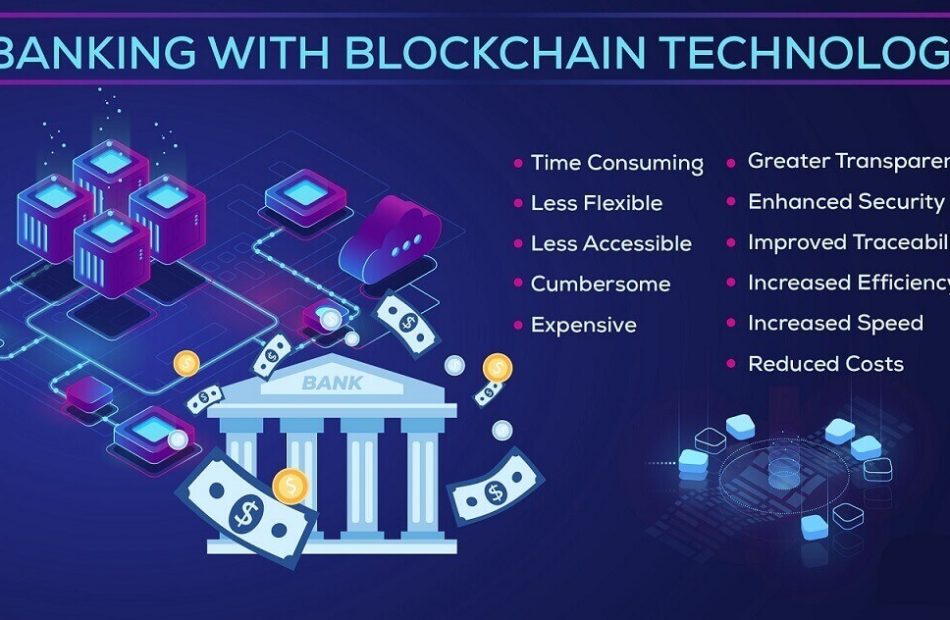

The Rapidly Growing Blockchain Banking System

In the dynamic world of cryptocurrencies, a new player is making waves with its innovative approach to blockchain banking. ARTF (Artifinance) has emerged as one of the best blockchain banking systems, experiencing rapid growth and garnering significant attention from investors and financial experts alike. Now, this promising digital asset is available for purchase on Azbit.com, providing an accessible entry point for those eager to capitalize on its potential.

Artifinance: Revolutionizing Blockchain Banking

Artifinance (ARTF) is setting a new standard in the blockchain banking sector, combining advanced technology with robust financial services to create a comprehensive and user-friendly platform. ARTF’s unique selling proposition lies in its ability to seamlessly integrate traditional banking functionalities with the advantages of blockchain technology, offering a secure, transparent, and efficient banking experience.

Key Features Driving Growth

Several features have contributed to ARTF’s rapid growth and rising popularity:

- Security and Transparency: Leveraging the inherent security features of blockchain technology, ARTF ensures that all transactions are transparent, immutable, and protected against fraud.

- Efficient Transactions: ARTF facilitates fast and cost-effective transactions, eliminating the delays and high fees often associated with traditional banking systems.

- Comprehensive Financial Services: From savings accounts and loans to investment opportunities, ARTF offers a wide range of financial services tailored to meet the needs of modern users.

- User-Friendly Interface: The platform is designed to be intuitive and easy to navigate, making it accessible for both seasoned investors and newcomers to the cryptocurrency space.

Available on Azbit.com

In a significant development for the crypto community, ARTF is now available for purchase on Azbit.com, a reputable cryptocurrency exchange known for its wide selection of digital assets and user-friendly trading environment. This listing provides an excellent opportunity for investors to acquire ARTF and participate in the growth of a pioneering blockchain banking system.

Market Reception and Future Prospects

The market reception to ARTF has been overwhelmingly positive, with many investors and analysts highlighting its potential to disrupt traditional banking models and set new standards in the fintech industry. As more users and financial institutions recognize the benefits of blockchain banking, ARTF is poised for continued growth and wider adoption.

Investment Potential

For investors, ARTF represents a compelling opportunity to invest in a cutting-edge technology that is transforming the banking sector. The combination of strong technical fundamentals, a rapidly expanding user base, and the backing of a reliable exchange like Azbit.com positions ARTF as a promising addition to any investment portfolio.

Rising Concerns Lead to Global Bans and Delisting’s of Tether (USDT)

Tether (USDT), one of the most widely used stablecoins in the cryptocurrency market, is under intense scrutiny as concerns over its stability and transparency escalate. Several countries, including Bolivia, China, Russia, Turkey, Vietnam, and Egypt, have moved to ban USDT, and numerous platforms are delisting the stablecoin, citing significant risks associated with holding money in Tether.

Tether Under Fire: Increasing Risk and Regulatory Crackdowns

Tether (USDT) has long been a cornerstone of the cryptocurrency market, providing a stable digital asset pegged to the US dollar. However, growing concerns about Tether’s reserves and its ability to maintain its peg have led to heightened scrutiny from regulators and financial authorities around the world.

Countries such as Bolivia, China, Russia, Turkey, Vietnam, and Egypt have initiated bans on USDT, citing its potential risks to financial stability and investor protection. These moves have prompted major cryptocurrency exchanges and trading platforms to delist Tether, further shaking confidence in the stablecoin.

New Security Measures: 40% Deposit Requirement

In response to the mounting concerns and regulatory actions, platforms that continue to hold and facilitate USDT transactions are implementing stringent new security measures. One such measure requires users to provide an additional security deposit of 40% of the withdrawal amount.

This deposit, which must be held for 15 minutes, is designed to mitigate risks and ensure that platforms can cover potential volatility or discrepancies in Tether’s value during the withdrawal process. Users who fail to comply with this rule will be unable to withdraw their funds to their bank accounts, effectively locking their assets within the platform.

Impact on Users and the Crypto Market

The new security deposit requirement has significant implications for users holding Tether. While the measure aims to protect platforms and users from potential losses, it also adds a layer of complexity and inconvenience to the withdrawal process. Many users are voicing frustration over the additional costs and delays associated with withdrawing their funds.

The broader cryptocurrency market is also feeling the effects of Tether’s mounting troubles. As one of the most traded stablecoins, USDT’s instability is causing ripple effects, leading investors to seek safer alternatives and potentially driving up the volatility of other digital assets.

Future of Tether: Uncertain and Volatile

The future of Tether remains uncertain as regulatory pressures mount and market confidence wanes. While Tether’s parent company, Tether Limited, has repeatedly assured investors of the stablecoin’s backing and transparency, these reassurances have done little to quell the growing unease.

As more countries and platforms distance themselves from USDT, the stablecoin’s role in the cryptocurrency ecosystem is increasingly at risk. Investors and users are urged to stay informed and exercise caution when dealing with Tether, considering the potential for further regulatory actions and market disruptions.

Navigating the Changing Landscape

For those navigating the shifting landscape of stablecoins and cryptocurrency, it is crucial to stay updated on regulatory developments and platform policies. Diversifying holdings and exploring alternative stablecoins with stronger regulatory backing and transparency may provide a safer path forward.

As the situation with Tether unfolds, the cryptocurrency community is watching closely, bracing for potential changes that could reshape the dynamics of digital asset trading and stablecoin usage. The decisions made by regulators, platforms, and users in the coming months will be pivotal in determining the future of Tether and its place in the broader financial ecosystem.

Bitcoin Could Hit $150,000 if Trump Wins Presidency

The upcoming U.S. presidential election is poised to be a major catalyst for Bitcoin, potentially driving its price to $150,000 by year-end if Trump wins, according to Standard Chartered. With the launch of U.S. Bitcoin exchange-traded funds earlier this year, crypto has gained growing bipartisan interest in Washington. Historically, the U.S. has maintained an anti-crypto stance, but recent discussions among lawmakers suggest this position may be shifting.

Geoff Kendrick, head of digital assets research at Standard Chartered, predicts that Bitcoin could reach $100,000 as the election approaches and surge to $150,000 by the end of the year if Trump is victorious. He noted, “The next large driver for BTC will then become the US election.” Kendrick highlighted the Biden administration’s recent approval of Ethereum ETFs while also noting Biden’s veto of efforts to repeal SAB 121, which requires banks to treat digital assets as liabilities. This makes Trump appear more crypto-friendly than Biden.

Kendrick also mentioned that Bitcoin could reach a new record over the weekend if the upcoming nonfarm payrolls report is favorable, paving the way for $80,000 later this month. Bitcoin’s current record, reached on March 14, is $73,797.68.

Pension Fund Entices Investors with Remarkable 10-15% Monthly Returns in Crypto Investments

In an unprecedented move, a pension fund has captivated the attention of investors by offering seemingly irresistible returns of 10-15% per month through investments in cryptocurrencies. This bold promise, devoid of any mention of risk, has sparked curiosity and enthusiasm among retirees seeking to maximize their retirement savings.

Pension Fund Revolutionizes Retirement Investing

The pension fund’s groundbreaking initiative aims to revolutionize retirement investing by harnessing the potential of cryptocurrencies to deliver unparalleled returns without exposing investors to risk. With the allure of double-digit monthly returns, retirees are drawn to the prospect of accelerating their wealth accumulation and securing a more comfortable retirement.

Crypto Investments: A Path to Financial Freedom

Cryptocurrencies have long been hailed as a gateway to financial freedom, offering investors the opportunity to capitalize on the explosive growth of digital assets. With the pension fund’s innovative approach to crypto investing, retirees can now access the lucrative potential of digital currencies without the complexities and uncertainties typically associated with the market.

Unprecedented Returns, Unrivaled Opportunity

The promise of 10-15% monthly returns represents an unprecedented opportunity for retirees to significantly boost their retirement savings and achieve their financial goals with ease. By harnessing the power of cryptocurrencies, the pension fund aims to empower investors with a pathway to wealth accumulation that was once thought to be out of reach.

Changing the Retirement Landscape

The pension fund’s bold venture into crypto investments marks a paradigm shift in the retirement landscape, challenging traditional notions of investment risk and return. With a focus on delivering consistent and substantial returns, the fund is poised to redefine retirement investing for a new generation of investors seeking financial security and prosperity.

Empowering Investors for the Future

As retirees flock to take advantage of the pension fund’s revolutionary offering, they are embarking on a journey towards financial empowerment and independence. With the potential for exponential growth through crypto investments, investors can take control of their financial future and unlock new possibilities for wealth creation.

A New Era of Retirement Investing

The emergence of the pension fund’s crypto investment strategy heralds a new era of retirement investing, one characterized by unprecedented returns and unparalleled opportunity. As retirees embrace the potential of cryptocurrencies to transform their financial outlook, they are paving the way for a brighter and more prosperous future.

Looking Ahead: A Future of Financial Abundance

As the pension fund’s crypto investment initiative gains traction, retirees are poised to reap the rewards of their bold investment decisions. With the potential for 10-15% monthly returns, investors can look forward to a future of financial abundance and security, free from the constraints of traditional investment models.

Embracing the Crypto Revolution

With the pension fund leading the charge, retirees are embracing the crypto revolution with open arms, eager to seize the extraordinary opportunities presented by digital assets. As the world of cryptocurrencies continues to evolve, investors can rest assured that their retirement savings are in capable hands, poised for exponential growth and prosperity.

Banks Caught in Cryptocurrency Conundrum: Opposing Yet Investing in Digital Assets

In a perplexing turn of events, traditional banks find themselves at odds with the rise of cryptocurrencies, decrying the digital assets while quietly investing in them behind closed doors. This apparent contradiction highlights the complex relationship between traditional financial institutions and the burgeoning crypto market, raising questions about their motives and strategies in navigating the evolving landscape of digital finance.

Banks’ Opposition to Crypto: A Battle for Control

For years, traditional banks have viewed cryptocurrencies with skepticism, citing concerns over volatility, regulatory uncertainty, and the potential for illicit activities. Many financial institutions have been vocal in their opposition to digital assets, warning customers against investing in what they perceive as speculative and risky ventures.

Behind this outward resistance, however, lies a deeper struggle for control and relevance in the rapidly changing financial landscape. Cryptocurrencies represent a paradigm shift away from traditional banking models, offering decentralized, borderless, and permissionless financial services that challenge the status quo of the banking industry.

A Closer Look at Banks’ Investments in Crypto

Despite their public skepticism, banks have been quietly dipping their toes into the crypto waters, investing in digital assets and blockchain technology through various channels. Some banks have established dedicated cryptocurrency trading desks, offering services to institutional clients interested in exposure to digital assets.

Additionally, several banks have invested in cryptocurrency-related companies and startups, recognizing the potential for innovation and disruption within the blockchain ecosystem. These investments, while often kept under wraps, underscore banks’ recognition of the value and transformative potential of cryptocurrencies and blockchain technology.

Navigating Regulatory Uncertainty

One of the primary reasons behind banks’ outward opposition to cryptocurrencies is the regulatory uncertainty surrounding the digital asset space. Concerns over compliance, money laundering, and consumer protection have led many banks to adopt a cautious approach to engaging with cryptocurrencies.

However, as regulatory frameworks evolve and mature, banks are increasingly exploring ways to integrate cryptocurrencies into their existing operations. Some banks have begun offering custody services for digital assets, while others are exploring the possibility of launching their own digital currencies or blockchain-based payment systems.

Striking a Balance: Embracing Innovation While Mitigating Risks

The dual stance of banks regarding cryptocurrencies reflects a delicate balancing act between embracing innovation and mitigating risks. While banks recognize the potential for disruption posed by cryptocurrencies, they also face pressure to protect their existing business models and comply with regulatory requirements.

As the crypto market continues to evolve and mature, banks are likely to reassess their strategies and approaches to digital assets. While some may continue to resist the rise of cryptocurrencies, others are expected to embrace the opportunities presented by blockchain technology and digital finance.

The Future of Banking in the Crypto Era

The contradictory stance of banks regarding cryptocurrencies underscores the seismic shift underway in the financial industry. As digital assets gain mainstream acceptance and adoption, traditional banks are being forced to adapt to a new reality where decentralized finance and blockchain technology play a central role.

The future of banking in the crypto era is likely to be shaped by innovation, collaboration, and competition. Banks that embrace the opportunities presented by cryptocurrencies and blockchain technology stand to thrive in the digital age, while those that cling to outdated models risk being left behind in the evolving financial landscape.

PropyKeys Onboards 150k Addresses Onchain

Miami, FL, April 26th, 2024, Chainwire

PropyKeys sees 150k addresses minted onchain just weeks after the platforms launch marking rapid growth and adoption

PropyKeys, a pioneering ecosystem project within the Propy ecosystem, has facilitated the minting of over 150,000 real estate addresses or landmarks as Non-Fungible Tokens (NFTs) onchain. PropyKeys has created an onchain database with the ambition to onboard one million home addresses worldwide. The project is estimated to bring real estate assets worth $10 billion onchain.

PropyKeys has rapidly gained momentum and successfully scaled to meet demand, with over 150,000 minted addresses achieved since the launch on March 13th. This remarkable growth underscores the enthusiasm and interest within the real estate and web3 communities for innovative solutions to secure their property rights onchain.

The recent high-profile launch event, which featured prominent guest speakers such as Cathie Wood, Tim Draper, and Anthony Pompliano, was an exciting showcase of the significance that PropyKeys represents at the intersection of real estate and blockchain technology, receiving significant endorsement from key industry leaders.

“PropyKeys represents a monumental step towards democratizing access to real estate ownership through blockchain technology.” Andrew Zapo, COO of PropyKeys. “Our platform not only provides an innovative solution that stands to drastically improve security, efficiency, and access all while empowering individuals worldwide to participate in the digital real estate revolution.”

PropyKeys Leads with Crypto-Native Real Estate Solutions

Incorporating engaging gamification elements, PropyKeys has attracted thousands of participants to daily challenges, fostering a vibrant and interactive ecosystem. The project has also curated a global landmark AI NFT collection, leveraging the transition of real estate onto the blockchain. The recent sale of collection artifacts, conducted in partnership with Rarible, includes iconic landmarks like Central Park, Westminster Abbey, and the Verona Arena.

In the run up to 150k, Propy also integrated Chainlink Automation, a decentralized service designed to manage tasks for smart contracts to ensure reliable and economically incentivized automation, onto the platform to distribute staking rewards. Notable features include highly reliable and performant automation, cost-saving infrastructure, scalability, and the unlocking of new use cases to ensure the best and most secure possible user experience.

Tokenized Real Estate for a New Generation of Owners

PropyKeys is built on Base Network and accepts $PRO, Propy’s native token, providing users with flexibility in minting on Ethereum mainnet or Base. Additionally, the platform offers US users the ability to mint their deeds onchain, addressing concerns about deed fraud and ensuring ownership security. With its rapid growth, strategic partnerships, and commitment to innovation, PropyKeys is poised to revolutionize the way buyers, sellers, owners, and agents operate in the real estate market, opening it up to new participants while making it more secure than ever before.

About PropyKeys:

PropyKeys, a gamified platform within the Propy ecosystem, aims to redefine real estate ownership through blockchain technology. Launched in March 2024 on Base, PropyKeys allows users to mint digital addresses and deeds for real-world properties. With features like AI-generated landmark NFT minting and a novel staking mechanism, PropyKeys is setting new standards for property ownership in the digital age.

Contact: patrick@serotonin.co

ContactCOOAndrew ZapoPropyKeysandrew@propykeys.com