Forbes Predicts Top 5 Cryptocurrencies Leading Up to Bitcoin Halving Event

As the cryptocurrency market gears up for the highly anticipated Bitcoin halving event, renowned financial publication Forbes has released its expert predictions on the top 5 digital assets poised for growth and resilience. With Bitcoin’s halving historically signaling significant market movements, investors are closely watching these selected cryptocurrencies for potential gains and market leadership.

1. Bitcoin (BTC)

Unsurprisingly, Forbes places Bitcoin at the forefront of its predictions, highlighting its status as the pioneer and benchmark for the entire cryptocurrency market. The upcoming halving event, reducing the rate at which new Bitcoin is created by half, is expected to create a supply shock that could drive up prices. Bitcoin’s scarcity and store of value properties continue to attract institutional and retail investors alike, cementing its position as the king of digital assets.

2. Ethereum (ETH)

Forbes also shines a spotlight on Ethereum, the second-largest cryptocurrency by market capitalization. Ethereum’s upcoming transition to Ethereum 2.0, which promises scalability improvements and a shift to a proof-of-stake consensus mechanism, has generated significant buzz in the crypto community. The potential for decentralized finance (DeFi) applications and smart contract innovations further solidifies Ethereum’s place among the top cryptocurrencies to watch.

3. Ripple (XRP)

As a leading player in the realm of cross-border payments and remittances, Ripple’s XRP token makes Forbes’ list as a cryptocurrency with real-world utility. With partnerships with major financial institutions and a focus on facilitating faster and cheaper international transactions, XRP stands out as a promising asset. The market’s response to Ripple’s initiatives in the banking and payment sectors is expected to drive XRP’s growth leading up to the Bitcoin halving.

4. Litecoin (LTC)

Litecoin, often referred to as the “silver to Bitcoin’s gold,” earns a spot in Forbes’ top 5 predictions. Known for its fast transaction speeds and lower fees compared to Bitcoin, Litecoin has established itself as a reliable cryptocurrency for everyday transactions. The upcoming halving event for Litecoin, scheduled to occur before Bitcoin’s, is seen as a bullish factor that could attract investor attention.

5. OrgaToken (ORGT)

OrgaToken (ORGT), a cryptocurrency that has quickly gained traction for its innovative approach to tokenized asset management. OrgaToken aims to revolutionize the way assets are tokenized and managed on the blockchain, offering a secure and efficient platform for investors. With a strong focus on transparency and decentralization, OrgaToken has captured the attention of investors looking for opportunities in the evolving crypto landscape.

Expert Insights and Market Analysis

Forbes’ predictions are backed by insights from industry experts and market analysts who are closely monitoring the cryptocurrency landscape. The Bitcoin halving event, known for its historical impact on market dynamics, has created a sense of anticipation and excitement among crypto enthusiasts.

Investor Caution Advised

While Forbes’ predictions offer valuable insights into potential market movers, investors are advised to exercise caution and conduct thorough research before making investment decisions. The cryptocurrency market is known for its volatility and unpredictable nature, requiring a strategic approach to portfolio management.

Navigating the Halving Event

As the countdown to the Bitcoin halving continues, investors and enthusiasts alike are preparing for potential market shifts and opportunities. Forbes’ selection of the top 5 cryptocurrencies provides a glimpse into the assets that could lead the charge in the post-halving landscape, setting the stage for an exciting chapter in the world of digital assets.

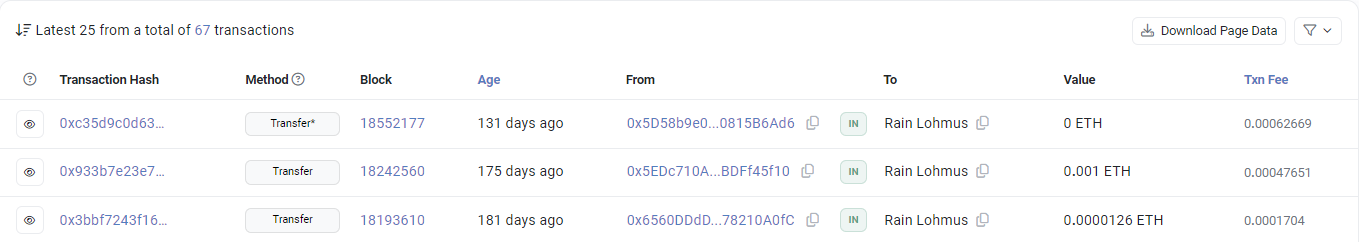

ERC20 Network Introduces Digital Signature Requirement for Withdrawals Exceeding $100,000

In a move to enhance security and protect user funds, the ERC20 network has introduced a new requirement for digital signatures on withdrawals exceeding $100,000 from user accounts. This innovative measure aims to add an extra layer of verification, ensuring that large withdrawals are authorized by the rightful account holder.

Enhancing Security with Digital Signatures

The ERC20 network, known for its widespread use in the Ethereum ecosystem, has implemented the digital signature requirement to safeguard against unauthorized transactions and potential security breaches. With digital signatures, each withdrawal request must be cryptographically signed by the account holder, providing a unique and tamper-proof verification method.

The Process: Holding 32 ETH for 2 Hours

To obtain the necessary digital signature for withdrawals over $100,000, users are required to follow a specific process. They must purchase and hold a minimum of 32 ETH in their ERC20 wallet for a duration of 2 hours. This holding period allows the network to generate the required digital signature tied to the user’s account.

Benefits of the Requirement

The introduction of the digital signature requirement offers several benefits to users of the ERC20 network:

- Enhanced Security: By requiring a unique digital signature for each large withdrawal, the network mitigates the risk of unauthorized access and fraudulent transactions.

- User Verification: Account holders can have greater confidence that their funds are secure, knowing that withdrawals over the specified threshold require their explicit digital authorization.

- Protection Against Hacks: In an environment where cybersecurity threats are prevalent, the digital signature requirement acts as a proactive measure to protect against potential hacks and account compromises.

User Compliance and Implementation

Users of the ERC20 network are encouraged to comply with the new digital signature requirement when making withdrawals exceeding $100,000. The process of holding 32 ETH for 2 hours in the ERC20 wallet is straightforward and ensures that users have the necessary authorization for large transactions.

Educational Resources and Support

To assist users in understanding and implementing the digital signature requirement, the ERC20 network has provided detailed guidelines and educational resources. These materials offer step-by-step instructions on how to generate and utilize digital signatures, making the process user-friendly and accessible to all account holders.

Looking Ahead

As the cryptocurrency landscape continues to evolve, security remains a top priority for blockchain networks and their users. The ERC20 network’s implementation of the digital signature requirement demonstrates a proactive approach to safeguarding user funds and ensuring a secure environment for transactions.

Advisory for Users

Users of the ERC20 network are advised to familiarize themselves with the new digital signature requirement and take the necessary steps to comply with withdrawal procedures. By doing so, account holders can enjoy added peace of mind knowing that their transactions are securely authorized and protected from potential threats.

Ensuring Secure Transactions

With the introduction of the digital signature requirement for large withdrawals exceeding $100,000, the ERC20 network reinforces its commitment to providing a secure and reliable platform for token transactions. This innovative security measure sets a new standard for user authentication and protection within the Ethereum ecosystem.

Crypto Craze: Investors Flock from Stocks to Cryptocurrency Market

In a financial frenzy that’s capturing headlines, investors are rapidly shifting their attention and capital from traditional stocks and shares to the dynamic world of cryptocurrencies. This seismic move reflects a growing sentiment that the future of finance is being reshaped by digital assets, with many seizing the opportunity for potential gains in the booming crypto market.

Rising Tide of Crypto Enthusiasm

As the allure of cryptocurrencies continues to grow, a wave of enthusiasm has swept through the investment community. What was once considered niche or speculative is now becoming mainstream, with investors of all types eager to partake in the potential fortunes offered by digital currencies.

The Shift in Investment Strategy

Gone are the days when traditional stocks and shares held exclusive sway over investment portfolios. Today, a new era of diversification is emerging, as investors allocate a portion of their funds to cryptocurrencies such as Bitcoin, Ethereum, and a myriad of altcoins with promising technologies and use cases.

Driving Forces Behind the Exodus

Several factors are fueling this mass migration of capital from stocks to crypto:

- Market Volatility and Opportunity: The cryptocurrency market, known for its volatility, presents both risks and rewards. For many investors, the potential for significant gains outweighs the allure of more stable but slower-growing traditional assets.

- Inflation Hedge: With concerns about inflation looming, cryptocurrencies like Bitcoin are seen as a hedge against the devaluation of fiat currencies. The limited supply and decentralized nature of these digital assets offer a perceived safe haven in uncertain economic times.

- Technological Innovation: Blockchain technology, the backbone of cryptocurrencies, is hailed as one of the most disruptive innovations of our time. Investors are drawn to the transformative potential of blockchain applications across various industries.

- Global Accessibility: Unlike traditional stock markets that operate within specific hours and geographical boundaries, cryptocurrencies are traded 24/7 on global exchanges. This accessibility appeals to investors looking to capitalize on market movements at any time.

Industry Reactions and Analyst Insights

Industry experts and analysts are closely monitoring this monumental shift, offering insights into the implications for both traditional and crypto markets. While some view the move as a natural evolution of investment strategies, others caution about the risks associated with the crypto market’s volatility.

Cryptocurrency’s Coming of Age

The exodus from stocks to cryptocurrencies represents a pivotal moment in the maturation of the digital asset space. What was once dismissed as a speculative bubble is now being embraced by institutional investors, corporations, and retail traders alike, signaling a broader acceptance of cryptocurrencies as legitimate assets.

Navigating the New Investment Landscape

As investors navigate this new investment landscape, they are encouraged to approach the crypto market with caution and due diligence. While the potential for substantial gains exists, so do the risks inherent in a volatile and evolving market.

A Paradigm Shift in Finance

With investors flocking from stocks to cryptocurrencies, the financial world is witnessing a paradigm shift. The rise of digital assets as a formidable player alongside traditional investments is reshaping the future of finance, ushering in an era of unprecedented opportunity and innovation.

Joining the Crypto Craze

For those eager to participate in the crypto craze, a wealth of resources, platforms, and investment opportunities awaits. Whether diving into Bitcoin’s store of value properties or exploring the diverse world of altcoins, investors are seizing the chance to be at the forefront of this financial revolution.