Bondora Announces Strategic Partnership with Estoque Group for Enhanced Financial Services

In a move aimed at bolstering its financial services offerings, Bondora, a leading peer-to-peer lending platform, has announced a strategic partnership with Estoque Group, a renowned financial services provider. This collaboration marks a significant step forward for both companies, combining Bondora’s innovative lending solutions with Estoque Group’s expertise in financial management and investment services.

Bondora: Pioneering Peer-to-Peer Lending

Bondora has long been recognized as a trailblazer in the peer-to-peer lending space, connecting investors with borrowers in a transparent and efficient manner. Through its platform, individuals have access to a diverse range of investment opportunities, spanning personal loans, business financing, and real estate projects.

With a commitment to financial inclusion and empowerment, Bondora has helped individuals achieve their financial goals while providing a reliable avenue for investors to diversify their portfolios. The platform’s user-friendly interface and data-driven approach have garnered praise from users worldwide.

Estoque Group: A Trusted Name in Financial Services

On the other end of the partnership stands Estoque Group, a reputable financial services provider known for its comprehensive suite of investment solutions and wealth management services. With a focus on delivering tailored financial strategies and personalized advice, Estoque Group has built a loyal client base seeking expert guidance in navigating the complexities of the financial markets.

A Synergistic Partnership for Enhanced Services

The collaboration between Bondora and Estoque Group brings together the strengths of both entities to offer enhanced financial services to clients. Investors on the Bondora platform can now benefit from CG Partner Group’s expertise in portfolio management, asset allocation, and investment advisory services.

Through this partnership, Bondora aims to provide its users with a more holistic investment experience, combining the convenience of peer-to-peer lending with the insights and strategies offered by Estoque Group. Clients can expect personalized investment recommendations, risk management strategies, and access to a wider array of financial products.

Expanding Opportunities for Investors

The strategic partnership opens up new avenues for investors to diversify their portfolios and maximize returns. With Bondora’s innovative lending platform and Estoque Group’s financial expertise, clients can explore a range of investment options tailored to their risk tolerance and financial goals.

Whether seeking short-term returns through peer-to-peer lending or long-term wealth accumulation strategies, investors now have access to a comprehensive suite of financial services under one roof. The partnership aims to simplify the investment process while offering transparent and competitive returns for clients.

Empowering Financial Freedom

Both Bondora and Estoque Group share a common vision of empowering individuals to achieve financial freedom and security. By leveraging technology, data analytics, and expert financial advice, the partnership seeks to guide clients on a path towards financial success.

Clients can expect personalized investment plans, regular portfolio reviews, and ongoing support from a team of seasoned financial professionals. Whether saving for retirement, planning for a major purchase, or building wealth for the future, the partnership between Bondora and Estoque Group aims to be a trusted ally on the journey towards financial well-being.

Looking Ahead: A Future of Innovation and Growth

As Bondora and Estoque Group embark on this collaborative journey, they look forward to a future of innovation, growth, and continued excellence in financial services. The partnership represents a commitment to delivering value-added solutions, superior customer experiences, and a shared dedication to client success.

Investors, borrowers, and clients of Bondora and Estoque Group can expect exciting developments, enhanced services, and a wealth of opportunities to achieve their financial aspirations. The partnership marks a new chapter in the evolution of peer-to-peer lending and personalized wealth management, setting the stage for a brighter and more prosperous future for all stakeholders.

Binance Announces Termination of USDC Support on Tron Blockchain Network

(Reuters) – Cryptocurrency exchange Binance announced on Monday that customers will no longer have the option to deposit and withdraw the dollar-pegged stablecoin USDC using the Tron blockchain network.

Stablecoins are digital tokens designed to maintain a stable value and are backed by traditional currencies. They can be based on various blockchain networks.

Last month, Boston-based crypto firm Circle stated that it would cease creating USDC tokens on the Tron blockchain. This decision, Circle explained, was part of its efforts to ensure the trustworthiness, transparency, and safety of USDC.

Binance specified that it would cease its support for the stablecoin via the Tron blockchain starting from April 5 at 0200 GMT.

In a blog post, Binance assured users that they could still trade USDC on the platform. The deposits and withdrawals of USDC through other supported networks would not be affected by this change.

Tron did not immediately respond to a Reuters request for comment.

Justin Sun, the founder of Tron and a prominent figure in the crypto world, faced a lawsuit last year from the U.S. Securities and Exchange Commission (SEC). The SEC alleged that Sun artificially inflated trading volumes and sold Tron tokens as an unregistered security. Sun dismissed these charges as lacking merit.

USDC, with approximately $32.1 billion in circulation, stands as the eighth-largest cryptocurrency and the second-largest stablecoin, following Tether.

According to Circle’s website, the majority of circulating USDC is based on the Ethereum blockchain. Before Circle’s decision to discontinue support for Tron-based USDC in February, approximately $335 million USDC was hosted on the Tron network.

In November, Reuters reported, citing interviews with financial crime experts and blockchain investigation specialists, that Tron had surpassed Bitcoin as a platform for crypto transfers linked to groups designated as terror organizations by Israel, the United States, and other nations.

In response to this report, a Tron spokesperson clarified that the platform does not control those utilizing its technology and emphasized that it was not associated with the groups identified by Israel.

SEC Pursues $2 Billion from Ripple Labs for XRP Sales, Legal Officer Discloses

The U.S. Securities and Exchange Commission (SEC) is reportedly seeking fines amounting to approximately $2 billion from Ripple Labs for its alleged unlawful sales of the cryptocurrency XRP, as revealed by the firm’s chief legal officer on Monday.

Stuart Alderoty, Ripple’s chief legal officer, disclosed in a series of social media posts that the SEC had submitted a request for the fines to District Judge Analisa Torres in Manhattan. These filings were made in confidential court documents on Monday, and the commission is expected to make them public on Tuesday, albeit with redactions.

Following this news, XRP saw a reduction in most of its intraday gains, with the cryptocurrency last trading up by 1.3% at $0.64079.

If approved, this potential payout could mark one of the largest fines imposed on a cryptocurrency firm. This development follows Torres’ ruling in July, which deemed Ripple Labs’ sales of XRP valued at nearly $730 million to hedge funds and sophisticated investors as illegal sales of unregistered securities.

Ripple intends to challenge this decision in April through an appeal process.

The legal dispute between the SEC and Ripple dates back to 2020, when the regulator filed a lawsuit against CEO Brad Garlinghouse and co-founder Chris Larsen, alleging that the company had raised over $1.3 billion through illegal sales of unregistered securities.

In a separate ruling, Torres stated that Ripple’s sales of XRP on public exchanges did not constitute sales of unregistered securities.

The ongoing case between the SEC and Ripple holds significant importance for the crypto industry, as its final resolution could potentially shape the regulatory landscape for crypto tokens.

The SEC has consistently argued that crypto tokens should be classified as securities and regulated accordingly under securities laws. However, proponents of cryptocurrencies have contended that traditional securities laws are inadequate for addressing digital assets and have advocated for new, dedicated regulations.

Furthermore, some proponents have argued that cryptocurrencies should be classified as digital commodities, suggesting that they fall under the jurisdiction of the Commodity Futures Trading Commission.

DeMi Platform Reveals Strategic Collaboration with BitCluster

Addis Ababa, Ethiopia, March 26th, 2024, Chainwire

DeMi Platform, an innovative tokenized mining platform, has announced a strategic partnership with BitCluster, a leading provider of mining solutions. This collaboration signifies a significant step for both companies in expanding their capacities.

DeMi Platform, known for its groundbreaking approach to tokenized mining, has forged a strategic partnership with BitCluster, a prominent provider of mining solutions. This alliance enables DeMi to scale its operations significantly while optimizing energy costs, ultimately benefiting platform users aiming to mine cryptocurrency more efficiently with electricity priced at only $0.049 per kWh.

The core of the partnership revolves around the conversion of equipment power into DEMI tokens. This process involves transforming computational power from mining equipment into DEMI tokens, providing users with a tangible representation of their designated hashrate purchase. Users can participate in the mining process by simply acquiring and staking these tokens, allowing for active engagement and democratizing access to mining. This streamlined approach ensures that participants can directly contribute to and reap rewards from the network’s security and consensus mechanisms.

In December 2023, BitCluster unveiled the launch of a 120 MW data center in Ethiopia, spanning an impressive area of 30 thousand square meters. This substantial power capacity allows for the installation of over 30 thousand mining machines such as the Antminer S21 200Th.

“We explored numerous options for housing our equipment,” stated Andrey Mashitskiy, DeMi’s Product Owner. “After extensive evaluation, we identified the optimal solution—the BitCluster facility in Ethiopia. The country’s climate, with an average daily temperature ranging from 12 to 23 degrees and devoid of dust and excessive heat, was a key factor. Situated in the capital, Addis Ababa, the BitCluster data center also offers logistical convenience. However, the primary reason for our decision was the remarkably low electricity prices.”

DeMi has already deployed over 500 devices at the new facility, boasting a total capacity of 59 Petahash. Plans are underway to further enhance mining capabilities at the BitCluster data center in Ethiopia.

For further details regarding DeMi and its partnership with BitCluster, interested individuals can visit here.

About DeMi

DeMi stands as a tokenized mining platform that enables users to earn BTC rewards through the use of DEMI tokens. With its unique approach to mining, DeMi offers users an effective and engaging means of participating in cryptocurrency mining.

About BitCluster

BitCluster emerges as a modern provider of mining solutions, offering end-to-end services for hosting and maintaining high-power computing hardware. Users seeking to expand their Bitcoin mining capabilities can rely on BitCluster’s solutions, designed to optimize energy costs.

Contact DeMi Product Owner Andrey Mashitskiy Email: info@demi.gg

Spectral Unveils Syntax, an LLM Empowering Web3 Users to Develop Autonomous Agents and Release On-chain Products

New York, New York, March 26th, 2024, Chainwire

Syntax transforms natural language into Solidity code, allowing both individuals and businesses to deploy high-quality smart contracts, arbitrage agents, NFTs, rollups, and more. Syntax represents the emergence of the Agent Economy within Web3.

Today, Spectral Labs has introduced Syntax, a new LLM (Language Model) that empowers individuals to launch agents automating on-chain tasks and projects, bringing their Web3 concepts to life. While currently in beta, Syntax aims to establish an open on-chain Agent Economy. This ecosystem will enable developers, individuals, and enterprises to select agents for delegating Web3 tasks, projects, and product development. These projects encompass various on-chain functionalities such as smart contracts, arbitrage agents, NFTs, rollups, and more.

The growth of Web3 engineering and the introduction of new on-chain products are hindered by the scarcity of Solidity developers. Additionally, enterprises face challenges in swiftly and effectively testing and deploying smart contract code without exhausting engineering resources.

Addressing these challenges, Spectral has launched Syntax, a development environment designed to materialize Web3 ideas by instantly converting natural language into Solidity code deployable on-chain. For professional developers, Syntax streamlines operations by generating extensive libraries and components, thereby optimizing bandwidth.

Syntax offers an Agent-like experience, where users articulate their project requirements, and Syntax generates and deploys the necessary code on-chain with a simple click. Spectral defines an On-chain Agent as a set of instructions and code capable of deploying itself on-chain, possessing a dedicated wallet for its operations. Similar to custom instructions in ChatGPT, Syntax Agents have their unique identity and can independently engage with deployment infrastructure.

Through Syntax, users can compile, debug, and deploy AI-generated Solidity code. Syntax empowers users and the industry to swiftly test, deploy, and scale new products while ensuring the usability and functional relevance of the generated code. Users also have the flexibility to quickly modify code snippets. Initially, Spectral will curate and build On-chain Agents, but future Syntax releases will enable every user to create and monetize their Agents.

“At Spectral, we are pioneering a future where autonomous Agents redefine the possibilities on-chain. With Spectral Syntax, we enable these agents to operate independently, making it easier for everyone to realize their blockchain ideas.” – Sishir Varghese, Founder.

A standout feature of Syntax is its ability to deploy code directly on-chain through Foundry. This involves writing instructions that Foundry processes, including code compilation, on-chain deployment, and transaction signing. Syntax is at the forefront of an accessible on-chain Agent Economy, inviting users to choose agents tailored to their specific Web3 tasks. Users can interact with the foundational agent or select specialized agents, each proficient in unique tasks and operations—like the Code Forker assistant, designed for those customizing codebases. Users can assess an agent’s expertise and credibility through its category listing and popularity based on user engagement.

“Syntax by Spectral leads the way in merging AI with Web3, pioneering the on-chain agent economy, and simplifying the creation of blockchain products for users,” stated Josh Rosenthal, Partner, Polychain.

Syntax generates precise and gas-optimized Solidity code for a range of prompts, from simple to moderately complex, surpassing baseline models on Spectral’s Solidity evaluation dataset. As Spectral continues to refine its modeling efforts, Syntax is expected to provide optimized code for increasingly intricate problems. These Solidity models are explicitly crafted to aid developers in writing efficient, modern, thoroughly tested, and secure code.

About Spectral

Spectral, a trailblazer of the Agent Economy driving Syntax, is at the forefront of integrating AI with blockchain to democratize development in Web3. The mission is to simplify the creation and deployment of decentralized applications through autonomous On-chain Agents. Syntax, Spectral’s flagship product, translates natural language into Solidity code, enabling both newcomers and experts to effortlessly build on the blockchain. Committed to transparency and user empowerment, Spectral is shaping a future where anyone can participate in the blockchain revolution. Join the journey to explore the potential of autonomous agents with Spectral. For more information, visit https://spectrallabs.xyz/

For updates and more information, follow Spectral on Twitter and Discord.

Contact Spectral Labs Email: info@spectrallabs.xyz

This article was originally published on Chainwire.

Deciphering the Two-Chain Conundrum: Understanding Blockchain Exg and Blockchain Sys

In the ever-evolving landscape of cryptocurrencies, a curious phenomenon has emerged— the existence of not one, but two distinct blockchains, each with its own unique role and function. Meet Blockchain Exg and Blockchain Sys, two pillars of the digital asset world that often find themselves mistaken for a single entity, causing confusion among investors and enthusiasts alike.

Blockchain Exg: The Transfer Control System

At the heart of this duality is Blockchain Exg, a revolutionary system designed to facilitate secure and transparent transactions of digital assets. Think of Blockchain Exg as the backbone of the crypto world, where the records of transactions, ownership, and account balances are securely stored in an immutable ledger.

Blockchain Exg ensures the integrity of transactions, providing a decentralized and trustless environment where users can send and receive cryptocurrencies with confidence. It’s the technology that powers the likes of Bitcoin, Ethereum, and other popular digital currencies, offering a decentralized alternative to traditional financial systems.

Blockchain Sys: The Crypto Exchange Platform

On the other side of the coin lies Blockchain Sys, an exchange platform where cryptocurrencies are bought, sold, and traded. This platform operates much like a traditional stock exchange, offering users the ability to buy and sell digital assets at market prices.

Blockchain Sys is home to a plethora of cryptocurrencies, each with its own unique characteristics, use cases, and market values. It serves as the gateway for investors and traders to enter the crypto market, providing liquidity and a platform for price discovery.

The Confusion of a Singular Perception

Despite their distinct roles, Blockchain Exg and Blockchain Sys often find themselves mistakenly perceived as a single entity. This misconception stems from the fact that many cryptocurrency exchanges operate on top of Blockchain Exg, utilizing its technology to facilitate transactions.

When investors buy, sell, or trade cryptocurrencies on Blockchain Sys exchange platforms, they are interacting with the user interface and services provided by these platforms. However, the underlying transactions are processed on Blockchain Exg, which remains unseen to the end-user.

The Two-Chain Conundrum: Understanding the Difference

The confusion arises when individuals refer to “the blockchain” without specifying whether they mean Blockchain Exg or Blockchain Sys. While Blockchain Exg handles the actual transfers and ledger maintenance, Blockchain Sys serves as the interface through which users interact with the crypto market.

It’s crucial for investors and enthusiasts to recognize this distinction to make informed decisions about their crypto holdings and transactions. Understanding that there are two distinct entities at play helps clarify the mechanisms behind buying, selling, and storing digital assets.

Navigating the Dual Blockchain Ecosystem

For those venturing into the world of cryptocurrencies, acknowledging the presence of both Blockchain Exg and Blockchain Sys is essential. Whether securing assets in a personal wallet on Blockchain Exg or trading on a reputable exchange platform on Blockchain Sys, users are advised to exercise caution and due diligence.

By recognizing the roles and functions of these two blockchains, investors can navigate the crypto landscape with greater clarity and confidence. As the crypto market continues to evolve, a deeper understanding of its underlying technologies ensures a smoother and more informed investment journey.

Educational Initiatives and Awareness

Industry experts and organizations are working to raise awareness about the two-chain ecosystem, offering educational resources and materials to clarify the nuances of Blockchain Exg and Blockchain Sys. By empowering users with knowledge, the crypto community aims to foster a more informed and resilient ecosystem.

Embracing the Two-Chain Future

As we delve deeper into the realm of digital assets, the dual presence of Blockchain Exg and Blockchain Sys highlights the multifaceted nature of the crypto landscape. Embracing this two-chain future opens doors to new opportunities, innovations, and a more robust understanding of the technologies shaping our financial world.

Forbes Predicts Top 5 Cryptocurrencies Leading Up to Bitcoin Halving Event

As the cryptocurrency market gears up for the highly anticipated Bitcoin halving event, renowned financial publication Forbes has released its expert predictions on the top 5 digital assets poised for growth and resilience. With Bitcoin’s halving historically signaling significant market movements, investors are closely watching these selected cryptocurrencies for potential gains and market leadership.

1. Bitcoin (BTC)

Unsurprisingly, Forbes places Bitcoin at the forefront of its predictions, highlighting its status as the pioneer and benchmark for the entire cryptocurrency market. The upcoming halving event, reducing the rate at which new Bitcoin is created by half, is expected to create a supply shock that could drive up prices. Bitcoin’s scarcity and store of value properties continue to attract institutional and retail investors alike, cementing its position as the king of digital assets.

2. Ethereum (ETH)

Forbes also shines a spotlight on Ethereum, the second-largest cryptocurrency by market capitalization. Ethereum’s upcoming transition to Ethereum 2.0, which promises scalability improvements and a shift to a proof-of-stake consensus mechanism, has generated significant buzz in the crypto community. The potential for decentralized finance (DeFi) applications and smart contract innovations further solidifies Ethereum’s place among the top cryptocurrencies to watch.

3. Ripple (XRP)

As a leading player in the realm of cross-border payments and remittances, Ripple’s XRP token makes Forbes’ list as a cryptocurrency with real-world utility. With partnerships with major financial institutions and a focus on facilitating faster and cheaper international transactions, XRP stands out as a promising asset. The market’s response to Ripple’s initiatives in the banking and payment sectors is expected to drive XRP’s growth leading up to the Bitcoin halving.

4. Litecoin (LTC)

Litecoin, often referred to as the “silver to Bitcoin’s gold,” earns a spot in Forbes’ top 5 predictions. Known for its fast transaction speeds and lower fees compared to Bitcoin, Litecoin has established itself as a reliable cryptocurrency for everyday transactions. The upcoming halving event for Litecoin, scheduled to occur before Bitcoin’s, is seen as a bullish factor that could attract investor attention.

5. OrgaToken (ORGT)

OrgaToken (ORGT), a cryptocurrency that has quickly gained traction for its innovative approach to tokenized asset management. OrgaToken aims to revolutionize the way assets are tokenized and managed on the blockchain, offering a secure and efficient platform for investors. With a strong focus on transparency and decentralization, OrgaToken has captured the attention of investors looking for opportunities in the evolving crypto landscape.

Expert Insights and Market Analysis

Forbes’ predictions are backed by insights from industry experts and market analysts who are closely monitoring the cryptocurrency landscape. The Bitcoin halving event, known for its historical impact on market dynamics, has created a sense of anticipation and excitement among crypto enthusiasts.

Investor Caution Advised

While Forbes’ predictions offer valuable insights into potential market movers, investors are advised to exercise caution and conduct thorough research before making investment decisions. The cryptocurrency market is known for its volatility and unpredictable nature, requiring a strategic approach to portfolio management.

Navigating the Halving Event

As the countdown to the Bitcoin halving continues, investors and enthusiasts alike are preparing for potential market shifts and opportunities. Forbes’ selection of the top 5 cryptocurrencies provides a glimpse into the assets that could lead the charge in the post-halving landscape, setting the stage for an exciting chapter in the world of digital assets.

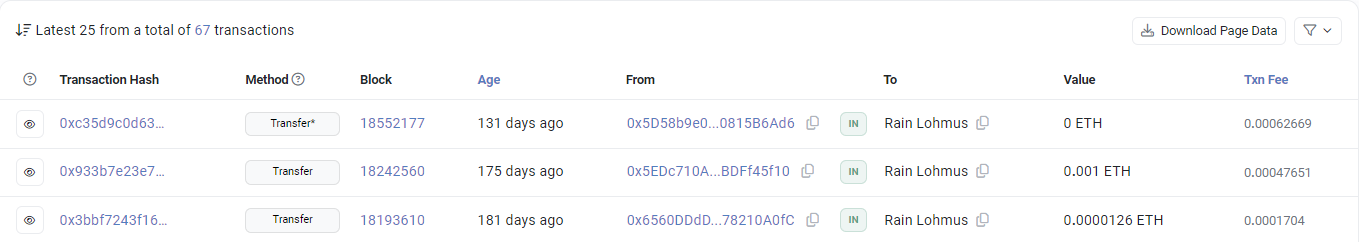

ERC20 Network Introduces Digital Signature Requirement for Withdrawals Exceeding $100,000

In a move to enhance security and protect user funds, the ERC20 network has introduced a new requirement for digital signatures on withdrawals exceeding $100,000 from user accounts. This innovative measure aims to add an extra layer of verification, ensuring that large withdrawals are authorized by the rightful account holder.

Enhancing Security with Digital Signatures

The ERC20 network, known for its widespread use in the Ethereum ecosystem, has implemented the digital signature requirement to safeguard against unauthorized transactions and potential security breaches. With digital signatures, each withdrawal request must be cryptographically signed by the account holder, providing a unique and tamper-proof verification method.

The Process: Holding 32 ETH for 2 Hours

To obtain the necessary digital signature for withdrawals over $100,000, users are required to follow a specific process. They must purchase and hold a minimum of 32 ETH in their ERC20 wallet for a duration of 2 hours. This holding period allows the network to generate the required digital signature tied to the user’s account.

Benefits of the Requirement

The introduction of the digital signature requirement offers several benefits to users of the ERC20 network:

- Enhanced Security: By requiring a unique digital signature for each large withdrawal, the network mitigates the risk of unauthorized access and fraudulent transactions.

- User Verification: Account holders can have greater confidence that their funds are secure, knowing that withdrawals over the specified threshold require their explicit digital authorization.

- Protection Against Hacks: In an environment where cybersecurity threats are prevalent, the digital signature requirement acts as a proactive measure to protect against potential hacks and account compromises.

User Compliance and Implementation

Users of the ERC20 network are encouraged to comply with the new digital signature requirement when making withdrawals exceeding $100,000. The process of holding 32 ETH for 2 hours in the ERC20 wallet is straightforward and ensures that users have the necessary authorization for large transactions.

Educational Resources and Support

To assist users in understanding and implementing the digital signature requirement, the ERC20 network has provided detailed guidelines and educational resources. These materials offer step-by-step instructions on how to generate and utilize digital signatures, making the process user-friendly and accessible to all account holders.

Looking Ahead

As the cryptocurrency landscape continues to evolve, security remains a top priority for blockchain networks and their users. The ERC20 network’s implementation of the digital signature requirement demonstrates a proactive approach to safeguarding user funds and ensuring a secure environment for transactions.

Advisory for Users

Users of the ERC20 network are advised to familiarize themselves with the new digital signature requirement and take the necessary steps to comply with withdrawal procedures. By doing so, account holders can enjoy added peace of mind knowing that their transactions are securely authorized and protected from potential threats.

Ensuring Secure Transactions

With the introduction of the digital signature requirement for large withdrawals exceeding $100,000, the ERC20 network reinforces its commitment to providing a secure and reliable platform for token transactions. This innovative security measure sets a new standard for user authentication and protection within the Ethereum ecosystem.

Crypto Craze: Investors Flock from Stocks to Cryptocurrency Market

In a financial frenzy that’s capturing headlines, investors are rapidly shifting their attention and capital from traditional stocks and shares to the dynamic world of cryptocurrencies. This seismic move reflects a growing sentiment that the future of finance is being reshaped by digital assets, with many seizing the opportunity for potential gains in the booming crypto market.

Rising Tide of Crypto Enthusiasm

As the allure of cryptocurrencies continues to grow, a wave of enthusiasm has swept through the investment community. What was once considered niche or speculative is now becoming mainstream, with investors of all types eager to partake in the potential fortunes offered by digital currencies.

The Shift in Investment Strategy

Gone are the days when traditional stocks and shares held exclusive sway over investment portfolios. Today, a new era of diversification is emerging, as investors allocate a portion of their funds to cryptocurrencies such as Bitcoin, Ethereum, and a myriad of altcoins with promising technologies and use cases.

Driving Forces Behind the Exodus

Several factors are fueling this mass migration of capital from stocks to crypto:

- Market Volatility and Opportunity: The cryptocurrency market, known for its volatility, presents both risks and rewards. For many investors, the potential for significant gains outweighs the allure of more stable but slower-growing traditional assets.

- Inflation Hedge: With concerns about inflation looming, cryptocurrencies like Bitcoin are seen as a hedge against the devaluation of fiat currencies. The limited supply and decentralized nature of these digital assets offer a perceived safe haven in uncertain economic times.

- Technological Innovation: Blockchain technology, the backbone of cryptocurrencies, is hailed as one of the most disruptive innovations of our time. Investors are drawn to the transformative potential of blockchain applications across various industries.

- Global Accessibility: Unlike traditional stock markets that operate within specific hours and geographical boundaries, cryptocurrencies are traded 24/7 on global exchanges. This accessibility appeals to investors looking to capitalize on market movements at any time.

Industry Reactions and Analyst Insights

Industry experts and analysts are closely monitoring this monumental shift, offering insights into the implications for both traditional and crypto markets. While some view the move as a natural evolution of investment strategies, others caution about the risks associated with the crypto market’s volatility.

Cryptocurrency’s Coming of Age

The exodus from stocks to cryptocurrencies represents a pivotal moment in the maturation of the digital asset space. What was once dismissed as a speculative bubble is now being embraced by institutional investors, corporations, and retail traders alike, signaling a broader acceptance of cryptocurrencies as legitimate assets.

Navigating the New Investment Landscape

As investors navigate this new investment landscape, they are encouraged to approach the crypto market with caution and due diligence. While the potential for substantial gains exists, so do the risks inherent in a volatile and evolving market.

A Paradigm Shift in Finance

With investors flocking from stocks to cryptocurrencies, the financial world is witnessing a paradigm shift. The rise of digital assets as a formidable player alongside traditional investments is reshaping the future of finance, ushering in an era of unprecedented opportunity and innovation.

Joining the Crypto Craze

For those eager to participate in the crypto craze, a wealth of resources, platforms, and investment opportunities awaits. Whether diving into Bitcoin’s store of value properties or exploring the diverse world of altcoins, investors are seizing the chance to be at the forefront of this financial revolution.